THESE DAMAGE STORIES WILL MAKE YOUR ART-LOVING HEART BREAK

Perhaps the most publicized story, in 2006 business magnate Steve Wynn infamously elbowed his most beloved and iconic painting, Picasso’s Le Rêve. The unfortunate mishaps took place while showing the painting to reporters. It cost $90,000 to repair the damage. So much for “off the records”!

To share a story from our own experience, one of our appraisers once witnessed a $15,000 chair get irreparably crushed between the doors of a freight elevator.

In 2015, King Tut’s chair was damaged in a move between museums as a result of pure carelessness. This unfortunate event followed news of botched restoration to the king’s mask. Let’s hope no one is haunted for the sub-par handling and treatment!

In 2004, Artnews shared the story of an employee at a SoHo gallery who enthusiastically unwrapped a poorly packaged work of art that had been shipped to them. To their utter dismay, he accidentally ripped up the drawing in his fervor.

While traveling from Paris to The Armory Show last year, a Lucio Fontana sculpture was found damaged in its crate. Still pending is the legal retribution for damage that Lloyd’s of London is seeking from the responsible art handling companies and airliner.

It is not uncommon for pets to damage a collector’s favorite work of art. In one instance, a painting resting against a wall fell onto a dog. The spooked dog leaped and pranced about on the painting, resulting in several punctures through the canvas.

WHEN FINE ART MEETS BUBBLE WRAP

by Simon Hornby, President of Crozier Fine Arts

With an increasing number of collectors shipping art from art fairs to their private homes, plenty can go wrong during transit. According to Simon Horby, President of Crozier Fine Arts, the majority of damage to art occurs when a piece is moved. Whether lending art to institutions for exhibit or shipping art from auction houses to tax advantaged locations such as Delaware or Switzerland, the movement of art can be a complex process.

For example, the client who chooses a ‘common carrier’ – a general commodity packer, shipper or storage business who will transport and store anything from art to furniture to bicycles – to transport their million dollar painting may find its canvas punctured upon arrival due to improper packing and handling. For this reason, the importance of selecting appropriate transportation and storage for valuable objects cannot be understated. Hornby emphasizes that works should only be transported using shippers experienced in handling art. To ensure safe transport, it is highly recommended that art is stabilized and transported in air-ride, climate-controlled, GPS- tracked and alarmed trucks. It is also recommended that clients get a condition report prior to having anything transported just to verify that no damage occurred during transit.

Choosing a company that has a TSA-approved Certified Cargo Screening Facility (CCSF) may also prevent damage during transit. Under TSA rules, all cargo, including packed crates, loaded onto domestic and international passenger flights must be individually screened. Screening may involve inspection, unpacking and handling of the artwork, which if performed by trained art specialists at a CCSF, ensures safe handling.

Lastly, find out whether third party shippers or other subcontractors will be involved, especially when hauling valuable objects long distances or internationally. If this occurs, make sure that the contracted party has experience transporting and handling fine art and also has adequate security measures in place (e.g., tracked trucks and background checks on its employees).

Although most damage to fine art and collectibles occurs during transport, the storage environment of these objects is equally critical. Best practices dictate that fine art be housed in a climate-controlled environment and in fire resistant, sole-use warehouses. Additionally, fine art storage facilities should be alarmed and equipped with 24-hour system monitoring and be properly insured.

Simon Hornby is the President of Crozier Fine Arts, the leading provider of global art logistic solutions.

I remember visiting my grandparents’ home on Central Park West. The home was a beautiful mosaic of antiquities, tribal art, period antique English and French furniture, modern paintings, oriental rugs and Tiffany lamps. Although today I visit homes of Billionaires and properties in excess of 25,000 square feet in gorgeous locations, I compare all homes to my grandparents’ two-bedroom apartment in NYC.

A truly elegant home is one that incorporates artwork and objects that stand alone. Paintings chosen because they match the sofa or have a “contemporary feel” are no different from the wallpaper. In conversing with many of my clients who work with designers for their interiors, it has become very clear to me that there is a fundamental lack of understanding of the importance and the process of marrying art and design.

The best designers understand that the fine art needs to be as important as the custom couch and the color scheme of the walls. Many of the architects we work with see the art as an essential component of their architectural vision for the structure. A team approach to designing a home results in the most elegant and appealing homes. When the Art Advisor, Designer, Architect and client work in tandem, magic occurs.

There are certain assumptions about incorporating art into a design project that need to be dismissed. The first and most prevalent is that “real art” is too expensive. How many times have I heard a client say, “I can’t afford real art.” This is the biggest myth of all. Whether the budget is $100,000 or $1,000,000, there are artworks available. Low edition prints by important artists, photography and art work by emerging artists, who show in major galleries and museums, can all be obtained within a prescribed budget.

Many designers are concerned that it is too difficult to find real art that fits a space. In fact, some designers will work with a handful of working artists who are commissioned to create works to fit a space. Every project looks the same because every home has a version of the same art. In addition, none of the commissioned pieces have any asset value. Today, there are so many ways to frame artwork to fit a space. The size of the mat and the frame can alter the size of an art work dramatically.

In addition, artwork that is not purchased for decorative purposes has a much better chance of holding its value over time. Therefore, when it is time to downsize or to alter the design style, you are not getting pennies for the artwork you spent thousands on. I recently compared decorative art work to penny stocks. They rarely increase in value. However, an artist who is part of the cannon of art history, typically holds his/her value or increases.

The last myth I want to dispel is that it is too hard to find real artwork within a design time frame. Just as a professional designer develops contacts to access the most interesting and beautiful textiles and unique pieces of furniture, the expert art advisor has contacts throughout the dealer, private and auction world. At The Fine Art Group, we have experts on staff in all areas of fine art who have deep connections with dealers in that art collecting space. Take the time to find a designer who understands the importance of marrying art and design. The result will be a home that stands the test of time and is a truly elegant and inspirational space.

– Anita Heriot

BARBARA DERCOLE DESIGN

As an interior designer for many years, I have acquired the valuable knowledge of knowing the importance of art in Interior Design. Creating a beautiful space that is cohesive requires some strategic practices that can make all the difference in the final outcome of a space. The style of decor should always complement the art and selecting a palette with that piece in mind will always satisfy. I remember following up on a client who had acquired a collection of art that did not work with the decor or architecture of the home. Through thoughtful design discussions and some small alterations of color, scale and design, the house was given a soul and a direction that guided everyone who entered this story – a story of the art and design of the home which existed where it did not exist before.

Hiring a design professional to help you through this process can make the difference in a room that speaks to you with confidence versus yet another room with art hanging on the walls. Another way to create this confidence is by combining multiple works of art by the same artist or works of art of a similar style. This always creates a greater impact. Working with architects and lighting designers is also a great way to showcase your collection with detail being focused on placement and impact.

If art is important to you, either because of the investment or how it makes you and your family feel at the end of the day, hiring a design professional should be a key component in your design planning.

Barbara Dercole Design

20465 Saratoga Los Gatos Rd.

Saratoga, Calif. 95070

www.barbaradercoledesign.com

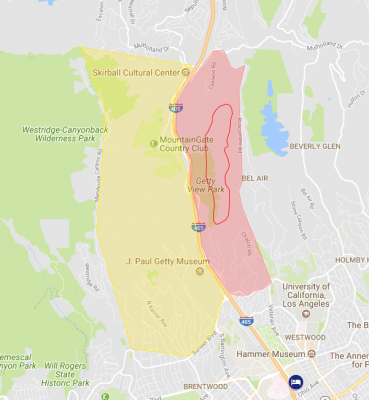

As a new wildfire closed part of Interstate 405 early Wednesday near Los Angeles’ Bel Air area, flames sweeping toward the Getty Center arts complex — one of a number of recent fires that have burned more than 83,000 acres, countless buildings and pushed thousands of people to evacuate their homes — the call for preparedness has never been more urgent.

Southern California Fire Evacuation Zones

The map outlines those communities in yellow which should be preparing to evacuate should the fire cross the freeway. The boundaries for the mandatory evacuation zone are Sunset Boulevard to the south, Roscomare Road to the west, and Mulholland to the north.

THE FINE ART GROUP’S PLAN OF ACTION

- Every home should have a complete and detailed inventory of their contents. You will need this information should the fire hit your home.

- It is wise to have an evacuation plan. The Fine Art Group can arrange for a packer/shipper to transport the art to a certified art storage facility should the evacuation be necessary.

- Make sure you have the correct insurance on your contents. If you have a blanket coverage, ensure the number is large enough. If you have pieces valued over your blanket per item limit, make sure you have scheduled and updated values. Our advisors are happy to connect you with excellent brokers who can provide you a full insurance review gratis.

Meet Roxanne Cohen our New Director of Art Advisory

Born and raised in London, Roxanne Cohen comes from an art collecting family. After 30 years in the UK, she relocated to NYC, the center of the contemporary art world. With years of experience as an independent art consultant, Roxanne now brings her skills to The Fine Art Group. For 5+ years, she worked at Christie’s Auction House within the Post-War and Contemporary Art Department and Client Advisory. Her extensive knowledge of the primary and secondary art markets helped clients build unique collections of work by various artists, both emerging and blue chip.

Roxanne has a Masters in Art Business from Sotheby’s Institute which is affiliated with Manchester University, a BA (honors) in History of Art and Architecture from Manchester University (UK), and a Certificate in Collections Management from Sotheby’s Auction House.

BUY WITH YOUR EYES, THEN WITH YOUR MIND

By this I mean, buy what you feel passionate about and then validate the purchase with your due diligence.

Loving the work must be the most important factor. You should take time to develop your eye, research and learn what it is that you love. Visit Museums, Art Fairs, Auction Houses, Galleries and follow people in the art-world on Instagram. Read as much as possible on artists you’re looking at, check their resume for important gallery and museum shows. Did an important collector own the piece you’re looking at? Has it been exhibited before? Have you checked auction results to make sure that you are paying fair market value?

Make sure you see the work in person. Photographs and PDFs can be digitally enhanced. It is also crucial that you have the correct measurements. Make sure your measurements reflect the size with frame. The work does not necessarily need to match an interior but should fit well in the space. Buying art for your home means that you will live with it every day; you don’t want to regret an ill-informed decision.

Looking for a work by an established artist on a lower budget? These blue-chip artists may remain out-of-reach for the collectors with lower budgets but there are more accessible works out there. An artist’s early drawings, studies, print editions for example, represent a good starting point for anyone wishing to own a work by a blue-chip artist. When buying, consider looking for works that capture the most distinct elements of an artist’s practice.

Don’t just ‘buy into the hype’ especially with young emerging artists. If you do, make sure you will love the work in the long run, as the emerging market can be very volatile.

It’s also important to buy quality not quantity when investing in art. Invest in fewer pieces that are higher quality. Art is a purchase for life, so it’s better to collect slowly with a focus than try to rush.

An art advisor can be used along the entire spectrum of the collection process – from early days when a simple educated walk through a fair may be a great start, to pricing works before acquisitions, to developing a comprehensive collection management strategy. Having a trusted advisor to work with can be a major benefit as they know you, your taste and are committed to building your collection with your values in mind.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

My wake-up call to the fires in Napa and Sonoma Counties happened one morning as I drove from my weekend home in Gold Country into the little town of Sonora where I do my daily shopping. The skies were overcast with a haze that reminded me of the rim fires of some years ago. The air smelled of smoke. I turned on the local radio station in fear of a local fire, only to hear that this was, in fact, the effect of a fire four hours away from my home in Sonora. As I drove to my primary residence in Silicon Valley, the haze became worse and the smell of smoke intensified. It seemed illogical to an east coaster like myself that the effects of smoke and fire could be experienced in areas two and three hours from the localized fire. Once I returned to Silicon Valley, the emails started coming in canceling outdoor activities. With information pouring in about iconic wineries and homes being engulfed in fire, I reached out to our clients who I knew had homes in Napa and Sonoma. I had personally valued and assisted in the collection management for some of these clients and I knew the quality of the collections. I started thinking of the wonderful Monet on the wall of one of my clients and the story he told me of how he and his wife purchased the piece on their first trip to Paris. Millions of dollars of art was hanging on the walls of my clients’ homes in Napa and Sonoma.

Calls did come in and I began the work of saving the art.

Each trip into the smoke filled skies of Napa and Sonoma were reminders of why I do my job. My work as a tangible asset manager, advisor and appraiser can be summarized by two principal missions: valuation and protection of our clients’ most treasured objects.

On the Tuesday of the fire, a broker called me to let me know that one of her clients purchased a home that included the previous owner’s art collection. They did not have paperwork on the art and were not sure of the art’s values. However, they wanted to make sure the collection was appraised and taken out of the home. I traveled to Sonoma with an art packer and shipper. As I went through the home, pointing to the pieces that needed to be extracted out of the home, I quickly deduced that several of the pieces were valuable; most notable was a work by a pre-eminent African American artist. The work was hanging in the study and I valued it at $325,000. Had the work not been valued, the client would have received no more than the blanket coverage of $10,000 for a loss. However, the broker, the client, my administrative staff and I worked as a team and we were able to provide an appraisal within one hour of being on site. The broker quickly added the piece to the insurance schedule and the work was accurately insured. When each team member works in synchronicity with the goal of protecting the client, we always win.

Another client in Napa reminded me of the deep relationship we have with the objects we own. I received a call from an insurance broker who asked that I reach out to his client in Napa. It was late in the afternoon and the night before the fire had reached the hill behind their home. Their home is a magnificent turn of the century structure. It is an icon to the origins of settlement in Napa. However, the owner was not concerned with the objects of value. He was most concerned about a small group of humble antiques that he had inherited from his grandmother. His question to me was, “could we send someone that evening to Napa to pack and ship the pieces to a safe art storage facility?” We whipped into gear and arranged for the packing and pick up that evening. The concern in the client’s voice that he may lose the modest side table or the American antique chest reminded me how important these objects are to our clients. It was so gratifying to be able to help ensure that his family’s antiques were saved and it reminded me that monetary value alone is not always the motivation for action around tangible assets.

We are all resting more comfortably as the fires have ceased and the work of rebuilding has begun. However, it is still essential that everyone is prepared in advance of the next natural event.

KEY WILDFIRE PREPAREDNESS TIPS

Marsh | Private Client Services

- Prepare Your Family: Design an emergency plan and discuss it with your family before wildfire strikes. Encourage each household member to assemble a “go bag” — a collection of necessary items in case of evacuation.

- Prepare Your Home: Regular home upkeep, such as clearing your roof and gutters of leaves and debris, is the most effective defense against wildfire.

- Prepare Your Property: Firefighting experts and other authorities urge homeowners in wildfire-prone areas to create a zone of defensible space around your homes to reduce the chance of ignition from radiant heat or embers and to provide firefighters a clear area to operate.

- Prepare Your Art Collection: Appoint a trusted insurance advisor who can assist you with appropriate fine art risk management practices and help ensure your items are properly protected. Document your collection with current valuations in accordance with the international Object ID Checklist standard created by the J. Paul Getty Trust, and keep it in an off-site safety deposit box. Create an emergency evacuation plan that prioritizes your items and specifies where and how each piece will be moved.

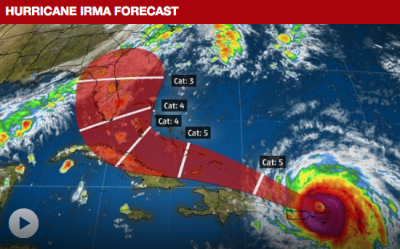

As Hurricane Irma sets its sights on Florida, Georgia and the Carolinas, The Fine Art Group has prepared a list of what to do before, during and after the storm to minimize the loss of tangible assets. Along the Gulf Coast in the wake of Hurricane Harvey, many residents are facing the consequences of inadequate insurance coverage and lack of planning for their tangibles. There has been a large increase in thefts, as well as flood and water-related damage to home contents including art, furniture, decorative arts and jewelry.

Image provided by Weather.com.

While protecting your tangible assets it is important to prioritize your safety, and the safety of family, friends, neighbors and pets. The National Hurricane Center and FEMA have provided additional guidelines and resources for hurricane preparedness.

Here is a list of suggested actions you should take now:

PREPARATION BEFORE THE STORM

- Discuss insurance coverage with your broker. Review your policy for costly gaps in coverage. If moving any fine art, verify that your collection is insured during transit. Some insurance companies have a waiting period before activation of policy changes, so plan ahead.

- Determine the type of damage your building and area is likely to suffer. Are trees likely to fall from strong winds? Have them trimmed regularly to remove weaker branches. Do you have lots of windows? Prepare to board them up. Are you located in a flood zone? Know where you can find sandbags in the event of an emergency and avoid storing valuables in the basement.

- Update your inventory with photographs and copies of your receipts. For maintaining records of your tangible assets, The Fine Art Group offers video inventories that can be shared with your insurance broker and used to reconstruct the contents of your home in the event of a loss. Think about items you have acquired recently or didn’t have included in a recent appraisal.

- Maintain a list of fine art shippers, art storage facilities, conservationists and your insurance broker. Turn your smartphone camera into a scanner with apps like CamScanner and Scannable to capture records and receipts digitally to store on the cloud and store important paper records in a waterproof safe.

- Establish a plan to relocate valuables. Select a reputable fine art shipper to move valuables to a predetermined secondary location out of the storms path.

- Collect all of the recommended items, below, for your Tangible Asset Emergency Kit.

- If you are likely to be away in the event of an emergency, communicate emergency plans with your property manager. Ensure they are aware of your valuables and know how to handle them during an emergency.

DURING STORM WARNINGS AND ACTIVE STORMS

- Board windows and establish a perimeter of sandbags around flood-prone zones.

- Remove art from damage-prone areas. This includes art facing windows and art hanging on walls made of plaster. Plaster becomes damp and may not have the structural integrity to support works of art.Learn from the mistakes of Hurricane Sandy and avoid storing valuables in the basement.

- Move works of art to a safe room, preferably a room without windows located at the center of the structure. Pack valuables in waterproof crates and plastic bins. Use acid free cardboard to prevent frames and works on paper from touching. You may also carefully wrap valuables in plastic poly to prevent water damage, possibly using acid free cardboard (and extra caution) to protect the surface. If possible, keep the works of art elevated from the floor should flooding occur.

- Monitor the storms progress and be prepared to evacuate.

HURRICANE EMERGENCY KIT FOR FINE ART PROTECTION

DEALING WITH THE AFTERMATH

- If the structure is secure, begin assessing the damage. Photograph overall damage to the site with subsequent photographs of specific damage.

- Do not throw away any damaged items! Even if the item is a total loss, consult with your insurance broker first and photograph the item for later claims.

- Move items out of harms way and to a safe, dry location.

- If necessary, put the dehumidifier and wet vac to use! Create an air-flow with fans and the AC. Clearing the air of moisture is key to preventing further damage from mold.

- Inspect the property for any new leaks and board up any damaged areas.

- Inform your insurance broker and begin the process of filing a claim. If faced with sizeable damage to your collectibles and art, establish a plan of action with your insurance broker in collaboration with art handlers, conservationists and appraisers.

MORE TIPS

Like an Emergency Kit, we recommend keeping these items on hand to manage your art collection in the event of a natural disaster. These items can be used to thoroughly document any damage, protect your collection as best as possible during an emergency, and prevent further damage from occurring.

- To document: Digital camera with extra memory card, batteries and charger, pencils, notepad, flashlights with additional batteries.

- To pack and transport: Latex gloves, rolls of plastic poly, packing tape, string tags, labels, scissors, box cutters, markers, acid free cardboard sheets and tissue paper.

- To protect during and after: Sand bags, plastic bins, waterproof crates, buckets, portable generator, dehumidifier, wet/dry vacuum, fans and extension cords.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

THE SCENARIO IS A SIMPLE ONE

Husband and Wife built an art collection over the course of the marriage. Wife, who had majored in art history during college, was responsible for selecting the pieces and attending the auctions; Husband paid the invoices. The art was on display in the parties’ residences.

The parties eventually decide to separate and divorce. During the intervening years, the collection appreciated in value. Husband claims that since he paid the invoices, the artwork belongs to him; Wife claims that Husband had no real interest in the artwork and it was effectively a “gift” to her during the marriage. There are no documents assigning title to either of the parties. Who is entitled to the art?

In New York, in the recent case of Anonymous v. Anonymous, 150 A.D.3d 91 (1st Dept. 2017), the Court was called upon to determine the ownership of valuable works of art in the parties’ collection. There, the Husband claimed that a collection worth tens of millions of dollars was his separate property, based upon the language in the parties’ prenuptial agreement which provided that any property “acquired” by a party would remain that party’s separate property. In support of his position, the Husband referred to the invoices which identified the Husband – and not the Wife – as the purchaser of the art.

However, the prenuptial agreement also provided that property which was “jointly held” by the parties would be considered “marital” property and would be equally divided between the parties. It was the Wife’s contention that the parties had agreed to acquire the art as a “joint collection” and therefore it was marital property.

The court found that although the invoices were in the Husband’s name, such invoices were not dispositive on the issue of ownership of the pieces, and remanded the matter for a hearing to determine all of the facts and circumstances surrounding the acquisition of the collection. What did this result mean to the parties in Anonymous? More time. More money. Risk.

What steps can you take to avoid this type of uncertainty and litigation?

- Make sure that each purchase is accompanied by a certificate of title or other document evidencing ownership.

- Make sure that your prenuptial (or post-nuptial) agreement provides that the party who pays for the piece is the owner, and that an invoice or bill of sale would be sufficient proof to establish title.

In the absence of a prenuptial (or postnuptial) agreement providing that title ownership controls the disposition of a particular asset, it remains critically important to maintain proper paperwork regarding the scope of your fine art and collectibles in the event of divorce. Why? Too often marriages dissolve and, because of one party’s “divorce planning,” pieces of art or other valuable items begin to disappear from a home, a second home or storage. The change may not even be initially decipherable. In the context of a divorce litigation, one party may claim he or she believes a watch is missing, or a piece of art was removed from a vacation home, without any way to prove this occurred beyond that person’s memory, leading to an inevitable “he said/she said” scenario.

How do you prevent this from happening to you?

- Check your insurance riders regularly. Make sure that they are up to date and modified as necessary to reflect sales and purchases.

- If you have fine art, jewelry and/or collectibles that are not insured, at a minimum, maintain an inventory (including photos), regularly update and, if possible, include the purchase price for each item.

The critical take-away in either scenario is the importance of maintaining and regularly updating the documentation reflecting the acquisition, ownership and sale of your fine art, jewelry and/or collectibles. The more objective proof there is, the less that will be left to chance.

Michael A. Mosberg, Esq.

Michael, a partner with the firm Aronson, Mayefsky, and Sloan, represents clients in all aspects of family law.

Heidi Harris, Esq.

Heidi, a partner of the firm Aronson, Mayefsky, and Sloan, handles all aspects of matrimonial and family law cases, including negotiating settlement and prenuptial agreements, trying cases and arguing appeals.

FAMILY DIVISION & DIVORCE VALUATIONS

An equitable division of marital assets demands an accurate and properly documented valuation. Pall Mall Art Advisors is regularly asked to consider the value of property acquired by an individual prior to the partnership, or through inheritance and the rise in value of jointly owned items due to market activity.

A pre-nuptial agreement which includes valuations of high value chattels, is increasingly seen as sensible. Again accurate valuations, subject to periodic review, are required.

When faced with the challenges of a divorce, the Visual Inventory provides an accurate account of marital property and is a necessary, date-stamped tool that facilitates the division of assets.

Have a professionally edited Visual Inventory conducted by a seasoned appraisal professional.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

Navigating the Art Market: The Pitfalls of Buying, Selling, and Valuing Your Fine Art

Originally Published Jet Set Magazine November 2014

Welcome to the most unregulated market in the world, the art market. As an art advisor and appraiser, I have seen the dark side of the industry: art appraisers that charge clients exorbitant fees, art advisors that broker fine art to clients at prices far above the painting’s real value, auction houses that lure clients to sell and their work goes unsold, dealers that place a huge price tag on a painting which has little or no value, and charlatans that hand out “certificates of authenticity” for fake works.

Don’t get me wrong; there are professional appraisers and auction houses that look after the client’s best interests. There is a cadre of art advisors that negotiate strategically on behalf of buyers and sellers of art, and dealers of the highest quality and the best taste. In this article, I will provide you with some guidance and help the art buyer and seller make smarter decisions. Navigating the art market correctly will make all the difference with your next fine art venture.

RULE #1

Just because an artwork is expensive, doesn’t mean that it has value.

The story usually goes like this. Mr. and Mrs. Smith go to Nantucket for vacation. A painting is purchased, a colorful seascape or a Nantucket scene, a memento of their trip. More than likely, the price tag for the painting is high. Jump ahead some years later. Mr. Smith and Mrs. Smith divorce. My firm, The Fine Art Group, is retained by Mr. Smith to conduct a valuation of their tangible assets. Mrs. Smith remembers spending $50,000 on the Nantucket painting and assumes it will be valued at a higher price.

As appraisers, we do our due diligence. We investigate the artist’s sales in the auction marketplace. In the case of the painting bought in a gallery while on vacation, it is likely that the artist’s paintings have never sold at auction. It is probable that the piece cannot be valued above $1,000. The price paid to a dealer is not its fair market value nor the price it will sell for in the open market. Fair market value is used for estate planning and estate taxes, equitable division, charitable donation, estimates for sale and when appraising a work used as collateral for a loan. It is not necessarily the price you paid for it. When buying at a gallery, have an independent appraiser provide an opinion of value before you write a check.

RULE #2

The auction house is not your friend.

Sure, it seems like they are your friends. They offered to do your appraisals for free, invited you to glamorous parties and private exhibitions. They arranged internships for your children and generously sent you their beautiful auction sales catalogues.

An auction house is trying to build up your loyalty so that when it comes time to sell, you call them first. Their actions are completely appropriate. The job of an auction house’s contemporary art department is to consign the best pieces at a commission rate that is profitable for the auction house. What you need to know is that the auction market is VERY competitive. At the highest level, there are two major auction houses, Sotheby’s and Christie’s, whose profit margins are quite small and who offer generally the same product. All of the auction houses below the two dominant players are even more competitive.

Some houses specialize in specific areas of the market such as Asian or American art, and some are general auction houses. The important point to remember is that like any competitive market, you need to let capitalism do its job. When selling a significant work of art, you want the auction houses to compete for the sale of your art.

An auction house makes its money from the buyer and the seller. From the buyer it charges a “buyer’s premium” which can range from 10 to 25 percent. For the seller, the auction house can charge fees for the following: shipping, insurance, photography, marketing, authentication, restoration, research and a “seller’s commission.” The good news is that depending on the work, all or some of these fees can be waived. At The Fine Art Group, we have negotiated on behalf of clients for the sale of their collections. When auction houses know that they are in a bidding war, commissions suddenly disappear, along with all of the other fees. If a seller is charged five percent to consign a $5,000,000 painting, the auction house will collect an additional $250,000 from the seller.

Our job is to ensure that the client is paying the least in commission and achieving the highest revenue. At times, the auction houses have been so keen to consign the collection that they have given the clients part of the buyer’s premium, as well.

RULE #3

Never hire an appraiser that charges a fee based on the value of the collection.

Traditionally, this fee structure was a common practice for an appraiser. The client would hire the appraiser to value a one million dollar painting and the appraiser would charge percentage of the value of the painting as his or her fee. If the appraiser charged 2.5 percent of the value of a one million dollar painting, the fee would be $25,000. If the painting was worth $10,000, the appraiser would charge $250. The incentive to overvalue the client’s work is obvious.

Recently, a very unhappy client called us with a story of a prominent appraiser still engaging in this practice. The appraiser charged $100,000 for the valuation of six paintings and stated that her fee was based on a percentage of the value of the painting. According to the standard practice of our profession, an appraiser’s fee for service must be hourly or based on a predetermined amount agreed upon by the appraiser and the client. Appraisers that charge these ridiculous fees give the profession a bad name.

RULE #4

A certificate of authenticity does not mean the item is authentic.

In 2014, a client called us seeking to sell her collection of 100 paintings. After looking at her list of artists, I was encouraged. She owned a Chagall, Dali, Miro, and Picasso, to name a few. I dug deeper into the collection, asking her where she bought the paintings and what she paid. My excitement for the collection dropped immediately when she told me that “they all had certificates of authenticity” and she had purchased them all while traveling on her yearly cruise. Certificates of authenticity can be downloaded off the Internet. Even worse, she had paid high retail for each of the works and I knew that the majority were fakes.

I showed her list to seven or eight auction houses and each told me the same thing. They would get pennies on the dollar for each work. One of the hardest messages to deliver to a collector is that their treasures have little to no value. Just because the work is signed by Chagall doesn’t mean that it is an original Chagall. In fact, if one looks closely at many of the certificates of authenticity, the small print clearly delineates that the work is a replica or print of an original.

The goal of this article is not to dissuade you from buying or selling art or having your art appraised. When buying a painting from a dealer, ask for an independent opinion. So many of our clients seek counsel from our firm before they make a purchase of thousands of dollars. When selling anything at auction, go to more than one auction house. If you are not comfortable doing that yourself, have an independent advisor negotiate on your behalf.

When hiring an appraiser, ask a few simple questions:

- What is the fee structure? You want to ensure they base their fee for service on an hourly rate.

- What is their experience valuing your material? You never want an American furniture specialist valuing your Asian works.

If you are provided a “certificate of authenticity,” read the small print and seek the guidance of an independent appraiser to advise you on the correct value of the piece. If you follow these basic rules, you will successfully be able to buy smart, sell smart and ensure your collections are valued correctly, thus effectively navigating the art market.

Anita Heriot: Before becoming President of The Fine Art Group, a U.S. and U.K. appraisal and art advisory firm, Anita Heriot served as Vice President, Head of Appraisals, and ran the British & Continental Furniture and Decorative Arts department for Samuel T. Freeman & Company. She also worked for Masterson Gurr Johns International, a London-based firm, as an appraiser. Ms. Heriot is a member of the Appraisers Association of America, is USPAP certified and has testified as an expert witness in major court cases involving art valuations. She is a graduate of Bowdoin University with advanced degrees from University of London and New York University.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

BURGUNDY, SUPER TUSCANS AND CULT CALIFORNIAN WINES ARE CATCHING TOP DOLLAR

DIVERSIFYING YOUR CELLAR WITH INVESTMENT-QUALITY WINES

With an uncertain market climate, savvy investors are turning to unconventional investments in efforts to diversify their portfolio, minimize losses, and maximize gains. While some markets have cooled in the uncertain market climate, others have soared: the ultimate example being the Wine Market, which has demonstrated sizable gains and resilience. According to Cult Wines, data compiled over the last thirty years shows that a £5,000 investment in the FTSE 100 in 1984 would now be worth £34,473; The same investment in 18 cases of Lafite Rothschild 1982 would be worth £698,832. Even on a broad scale, the Liv-ex 1000 closed in 2016 at a record high with gains of 22.3% over the course of the year.

While Bordeaux continues to perform strongly, other wine regions of the world are producing investment quality fine wines that have increased significantly in market prominence. In fact, the best performing sub-index of the Liv-ex 1000 is ‘Rest of the World 50’ (the ten most recently physical vintages for five wines from Spain, Portugal, the USA, and Australia) which increased over the last five years by a staggering 47.48%.

As a growing component of the tangible asset portfolio, wine cellars void of Bordeaux should not be overlooked. Due to market misconceptions, these areas represent the greatest potential for amplified risk exposure and oversight in effective portfolio management. High performing regions include Burgundy, Italy and California, as well as exploratory investment potential in South Africa and Australia, among others.

Here are some top market performers to be aware of when assessing a cellar:

FRANCE

Bordeaux producers carry with them the prestige of an ironclad reputation established by consistent quality and cellaring potential–which interprets to strong long-term investment potential. Leading châteaux include familiar names such as Mouton-Rothschild, Margaux, Lafite-Rothschild, Haut Brion and Latour. These ‘First Growths’ routinely captivate international buyers at leading auction houses; In October 2016, Christie’s London auctioned eleven bottles of Latour 1945 for $43,217 and, more recently, a case of twelve bottles of Château Palmer 1961 sold for $33,476.

Burgundy, a region known for its superb red and white wines with a market driven by scarce quantity, producing only 25% the quantity of Bordeaux (excluding Beaujolais). Yet this small production has outperformed Bordeaux with the Liv-ex Burgundy 150 indicating a 44.3% increase over the last five years. Among the most renowned producers is Romanée-Conti. In 2014, Sotheby’s made headlines with the sale of a superlot comprised of 114 bottles of Romanée-Conti spanning from 1992 to 2010. The lot achieved a record-setting $1.6 million, calculating to $14,121 per bottle.

ITALY

According to Wine Investments, select Italian wines are becoming increasingly prized as part of a well-rounded investment portfolio. In the last year alone, the Liv-ex Italy 100 has increased 18.26%, which coincides with increased interest as well as concerted efforts to increase Italian wine exports, up 17% in 2016. Fine wines with investment potential include producers in Piedmont and Tuscany, most notably the Super Tuscans, including vintages from the producers’ Sassicaia, Ornellaia, Masseto, Tignanello and Solaia. In today’s market, the legendary 1985 Sassicaia, often described as perfezionare, retails as high as $6,000 per bottle.

CALIFORNIA

With the growing interest in fine wines from the New World, California is one of the largest producers with investment quality dominated by the ‘Cult Californian’ Wines. These wines are produced in extremely small volumes, have notable cellar-potential and routinely obtain high scores, thus driving the market to some of the highest values paid for wine. Leading California fine wines include Scarecrow, Harlan Estates and Screaming Eagle. In 2000, a single bottle of Screaming Eagle Cabernet 1992 raised a staggering $500,000 for charity, the sale of which still has yet to be beat.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

SUMMER FEVER: BUYING SMART WHEN THE HEAT WAVES HIT

HOW TO AVOID VACATION IMPULSE ACQUISITIONS AND BUYER’S REMORSE

Have you ever bought a work of art that seemed like a great idea at the time, but now you can’t stand to look at it? We all have those precious paintings hiding in our closet, out of sight, and we remain puzzled why we were ever drawn to the piece in the first place.

Some blame those long summer nights, others succumb to impaired judgment on hot afternoons after that complimentary glass of wine at the gallery opening. Whatever the reason, vacation art always looks better on the beach and buyer’s remorse is in full vengeance post summer vacation.

Images courtesy Christie’s

So, how can you avoid the mistake of acquiring a painting you won’t like come Thanksgiving?

EXAMPLE #1

- Problem: You let your emotions do the buying and have acquired a gauche work of art. We always advise our clients to buy what they love, but this notion can run away with you when under the sun of your favorite summer hot spot. After all, the gallery opening was happening, you met the artist, and you were swept away by the idea of your vacation colliding with a paint bucket. But after your tan has faded, will the painting really bring back the memories? Is this the best you can find at that price? Does the work of art sync with the other pieces in your collection? Do you really love it? And we mean, really?

- Solution: Sit back and assess. You are on vacation, so what’s the rush? Ask the gallery if you can have a period of time, say three days to a week, to consider the painting before they sell it to someone else. If they are a good gallery, they will give you the courtesy of a phone call should another buyer show interest. If you still love it within that grace period, then get it home! But you may be relieved you did not rush.

Image courtesy Christie’s

EXAMPLE #2

- Problem: You are uncertain which artists have long-term market potential. It is all everyone seems to be talking about! And all the information can be challenging to apply when it comes to actually purchasing a work of art. But it starts with identifying quality.

- Solution: Learn to distinguish between Decorative Quality and Investment Quality. We always encourage clients to buy what they love, and sometimes it will be a decorative piece. But it is possible to buy what you love and acquire smart. The best place to start is discussing your collecting interests with your art advisor. Or even frequenting museums a bit more often. Which brings us to…

Image courtesy Pierre Bergé & Associés

EXAMPLE #3

- Problem: You haven’t been to a museum in months, maybe years. You need to look at the best to understand quality. Regularly visiting the permanent collections and curated exhibitions of museums is the greatest way to do that.

- Solution: Check out these great summer exhibitions! This is the final month to see The New Museums’ exhibition of new works by Lynette Yiadom-Boakye, which concludes September 3rd. The Hunter Museum of American Art in Tennessee just opened Thrill After Thrill: Thirty Years of Wayne White on June 30th. Meanwhile, the Seattle Art Museum is exhibiting Spencer Finch: The Western Mystery. If you are in Raleigh, The North Carolina Museum of Art is exhibiting a curated photography exhibition titled You + Me now through September 3rd.You can always request your art advisor arrange specific visits to museums, galleries and art fairs. Having a knowledgeable advisor by your side can prevent some of common pitfalls and buyer’s remorse.