Art Investment: True Value vs. Emotional Value

Being that the purpose of art is to evoke emotion, it is hard not to let emotions play a big part in its acquisition. Successfully acquiring art requires you to put that emotion aside and make an assessment of the true value of the piece based on an objective set of criteria, especially if you are looking to procure art at least in part for its future investment value.

When you find a painting or another piece of art that interests you and you begin to consider purchasing it, conducting due diligence is a critical step. The piece should be passed through a series of important “quality control” criteria. Then, if you or a trusted expert determines that the quality is excellent, you can begin reviewing the market analytics around the investment opportunity and begin negotiations.

Due Diligence Before Acquiring Artwork

It is important to consider key quality criteria as the foundation of high-quality artwork, regardless of price:

- Artist: Obtaining information about the artist will go a long way in determining the piece’s value. You should ask: How successfully does the artist sell at auction? How many times has the artist sold at auction? If the artist does not sell at auction, which galleries represent the artist? Is the artist represented in museum holdings? Has the artist participated in important exhibitions?

- Medium: Generally, original works such as oil on canvas, watercolor, or ink-on-paper have a better chance of continuing to go up in value. Prints can be an excellent acquisition, but be careful of edition size and quality.

- Size: A small work will never achieve growth in value beyond a certain point, and works between 16 inches and 40 inches are the most logical size. However, some contemporary artists may always work in larger sizes.

- Subject Matter: When you think of Andy Warhol, you may think of a Campbell’s Soup Can. That is because this is the subject matter, which is the essence of the Pop Art movement. The price for one of his works depicting a Soup Can will always surpass the price of a portrait of an unrecognizable figure.

- Rarity: A work that is fresh to the market and has never been seen will generally be more expensive. A rare edition bronze or a low edition print will generally be more expensive than a high edition print.

- Provenance: A painting previously exhibited in important shows and recorded as owned by notable collectors will have a higher price. In addition, provenance helps to establish the authenticity of the painting.

- Sales History: This is a huge red flag. Many dealers will acquire paintings when they go unsold because they can buy them at a better price. It is essential that you confirm the sales price at auction. Understanding the market for the artist is the beginning of your negotiation.

When you have the answers for each of these questions and all of the above criteria, you will have enough information to negotiate. In the art world, knowledge is power, and the information you gather will help you determine the most accurate price and whether the work is a good asset acquisition. While this may seem like an overwhelming amount of information needed to acquire a work, you will find that it will be worth it. At The Fine Art Group these criteria are applied to every acquisition and to every value. As a result, we likely can save a client upwards of 20 percent on a work of art.

Art Purchasing Strategies

There are other factors to consider once you have acquired the work that will have an impact on your bottom line and cost basis. Where the work is stored and strategy for “use” can have a major impact on sales and use tax. For example, if the artwork is stored in Oregon or Delaware, which are states that do not have a sales tax, this can be waived. In addition, creating a “use” strategy for the artwork can also save you from paying a use tax. Californians need to be particularly careful of the use tax.

Remember, don’t purchase a piece based on emotion. Be sure to conduct your due diligence before you acquire any works of art.

Read the Article on the Tiger 21 Website

Further Readings

- Is Art a Good Investment?

- The Asking Price: Understanding Value # 1

- The Asking Price: Understanding Value #2

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

WHAT MAKES COLLECTING CARS SIMILAR TO OTHER ASSETS?

Like fine art, many collectibles have seen significant appreciation in value over the past decade. This includes classic cars; which collectors purchase because they are passionate about the cars and can enjoy the asset. Unlike a stock or a painting, part of the fun is that the collector can drive a classic car.

Just as with art, the collector should obtain professional advice to choose a classic car wisely. A collector needs to understand the market and ride out the fads and will usually have to keep a classic car for several years before noticing any potential appreciation.

A collector also needs to be aware of the provenance of a car, understanding its history. Has it been well maintained? How many owners has it had? Has it been shown or won awards? If it has been restored, when was it done and by whom?

WHAT ARE THE BIGGEST CHALLENGES TO COLLECTING CARS?

Because of the illiquid nature of classic cars, there are several issues for collectors to consider. For instance, while a stock can be sold rapidly, finding a buyer willing to pay the asking price for a vintage car may take time, and the interest in different makes and models will differ. These longer cycles may not necessarily correspond with the collectors need to convert a classic car into cash.

While hunting for classic cars is exciting, it is important that collectors plan for their collections. A key issue is capital gains taxes. If the cars are appreciating, collectors should talk with a financial advisor or accountant regarding how to minimize the capital gains. Global trends and tastes change so it is important to follow the market and monetize when demand is strong.

Another concern is that vintage car parts may not be readily available. Since finding replacement parts for a rare car may be difficult or expensive, a newer collector may want to choose something not extremely rare.

It also may be difficult to find a good mechanic. The process of diagnosing automotive problems by sound alone is becoming a lost art. Modern mechanics rely on a host of computerized readers to determine what is wrong with an engine, and that equipment does not work with antique and classic cars.

Storage fees are yet another concern. Depending on how many cars a collector owns, special classic car storage facilities may be required.

CAR COLLECTING TRENDS

Factors such as scarcity, brand, age, condition, provenance and desirability can affect the value of a classic car. A supercar may be a high-risk investment, but it could be very lucrative. The most profitable supercars tend to be models that are in development and up for sale prior to delivery.

According to Steve Linden, classic car expert and CEO of Chrome Strategies, the interest in Preservation Class cars, ‘survivor cars,’ continues to grow. These are cars that are in good condition and have not been restored. Collectors face difficult choices in deciding whether to restore classic cars or leave the vehicle in its original state. The best appreciating classic cars are ones that were produced in limited runs and aspirational vehicles even when they were new.

FURTHER READINGS

- Art, Cars & Collectibles: How to Mitigate Risk Before a Disaster Hits

- Market for Sport Memorabilia Continues to Score Big

Whether you are building a wine, art or trading card collection, or determining the best way to sell your tangible assets, there are fundamental steps to follow.

ACQUISITION STRATEGY

Wine is a traditionally popular place to build assets, but trading cards are growing as viable alternative investments. While each must be approached differently, there are similarities in how best to establish your collection.

Charles Curtis is a Master of Wine and founder of WineAlpha, a fine wine advisory serving private, trade and institutional clients with an interest in the market for fine and rare wine.

He advises following these steps:

- Break it into sub-genres: Since what is true for Bordeaux is not necessarily true of Burgundy, you must understand the multi-year trends for each wine type. Slavishly following trends can result in strategic errors.

- Avoid the bubble: Right now, for example, Burgundy is trading at historic highs so finding value is tricky. To do so, know which producers are popular (Domaine de la Romanée Conti), where prices are rising (La Tâche) and where they are stagnant (the bottling from the Romanée Conti itself).

- Protect value: Pay attention to provenance, condition and rarity, factors essential to driving asset value in any category. For instance, there will be tens of thousands of cases of your typical first-growth Bordeaux produced and hundreds of cases of magnums, but only a few dozen to a few score of larger bottles such as double magnums (3 liters), jeroboams (5 liters) or imperials (6 liters).

- Avoid the “unicorn”: While rarity is important, maintain common sense. Certain wines such as Lafleur ’47 and magnums of Petrus ’29 are so rare that they are almost invariably counterfeit. To steer clear of problems, stick with wines that have a solid provenance and trading history.

- Play the arbitrage: Wine is a global category, so to get in at the right price don’t overlook sourcing in London or Hong Kong. Typically, London sales have the lowest prices, while the best property often comes up in Hong Kong (albeit at a premium).

- Pay attention to expenses, but don’t cut corners either: It is essential to use temperature-controlled shipping and storage and to insure wine end-to-end, but it is important not to overpay for these services, or to pay too much tax. As with everything, the devil is in the details.

While wine has long been popular in collecting for investment purposes, building a trading card portfolio is emerging as a very profitable undertaking. Growing interest was stoked by the sale in February 2018 of a 2000 Tom Brady Rookie Card for nearly $110,000 at auction, reflecting an almost 300% return on investment in just two years

Brent Huigens, CEO of PWCC, the largest trading card venue, lays out six essential rules for investing in trading cards:

- Establish a goal: Determine how long investments will be held and the return desired. Consider whether this will be an actively managed portfolio, which may require more time for tracking demand and pricing trends, or one that can be left alone to appreciate.

- Specialize in a sector: A trading card portfolio should revolve around a type of card – new or old, sports or non‐sports, mainstream or esoteric card productions, or from a specific era within vintage or modern cards. Investors can still diversify within a narrowly defined “sector,” and advanced investors might maintain several portfolios, each with a unique focus.

- Personalize to your interests: Consider gravitating toward a sector that resonates with you because the in-depth research and analysis essential to portfolio construction may be more enjoyable. A passion for the investment could separate the most successful investors from the pack; they are often more willing to dig into the industry’s detail.

- Pick a portfolio size: Whether available funds for this venture are $10,000 or $1 million, it is possible to create a well‐diversified portfolio. Clearly, a smaller budget may mean targeting lower-valued cards, but the ROI is as bright on both low and high value cards. Use historical sales tools to study the market, assess historical sales patterns and build future portfolio goals.

- Understand eye appeal: Evaluate the quality. Card values can be complex, relying on a combination of the card, its professional grade and the quality of a card within that grade, which can significantly impact market value.

- Seek professional guidance: Real‐time analytical tools and investment guidance that help develop an investors strategy and help pinpoint the right cards for a portfolio are available from professionals.

SALES STRATEGY

Selling your tangible assets is a very tricky business, so whether it’s just one item or a collection that you hope to sell, professional guidance is absolutely necessary. It’s a big mistake to do it alone if you want the best results. An advisor will make your endeavor effortless and transparent, and most importantly, ensure you get the highest return.

Anita Heriot, President of Pall Mall Art Advisors, uses the term “tangible asset fiduciary” to describe our work on your behalf in the sale process. A tangible asset fiduciary is a “fire wall” between the client and the auction house, dealer or art advisor. We are your representatives, making certain that the sale process works, that the work of art is placed with the best venue, and that all the steps for a successful sale are met.

We start by determining the most appropriate method and market for sale. While some works can and should be sold privately, others benefit from a more competitive market by being sold at auction in a specialized sale.

Several steps are necessary to ensure a good result at auction, and it starts with finding the right auction house. Although most regional and national auction houses have Fine Art Departments, only a select few have specialized sales that target the right collectors for a particular work. These specialized sales include more thematic categories like the annual “Orientalist Sale” at Sotheby’s in London or Copley Fine Art’s bi‐annual “Sporting Sale,” or regional specializations such as Freeman’s bi‐annual Pennsylvania Impressionists sale or Leslie Hindman’s “Made in Chicago” sale.

Using specialized sales is strategic because the auction venue has dedicated marketing and a focused clientele for the specific work to be sold. Even with the full scope and reach of the internet and international bidding, choosing the right brick-and‐mortar venue still can be the difference between a work selling and a work selling well.

To find the right venue and specialized sale for your artwork, our team looks at how many works of art by the artist in question have been sold by each one of several key auction houses we identify.

We utilize this same thought process when assisting with all tangible assets, including furniture, decorative arts and collectibles.

Equally important is negotiating the terms of the sale. The auction business is expense heavy because auction houses must insure the works while in storage, produce expensive catalogues, pay for expensive real estate and pay their expert staff. As a result, they try to look to sellers to absorb some costs by charging fees for photography, insurance, storage, shipping and marketing, as well as a seller’s commission. However, all of these fees can be waived if the collection has value.

Other essential steps include:

- Marketing: Ensure that your work is featured in any press and placed in a predominant place in the catalogue and in the internal auction marketing campaigns. To get a high price at auction people must be aware of your work of art. High exposure is essential.

- Estimates: These are the “secret sauce” to a successful sale. Auctions need a minimum of two people who want your work. Better yet would be 10 or more people bidding online, in the auction room or on the phone. Therefore, it’s best to place estimates that appear to be below the value of the work, giving you a much better chance at a higher return. It may seem illogical, but auction psychology requires emotion.

- Guarantee: For a very significant work of art, you may benefit from establishing an auction guarantee. While not always in your financial interest, it provides a safety net.

- Reserve: Set a reserve, the lowest number at which you are willing to sell your work. While not known to the public, a reserve should be set as close to the sale date as possible because a lot of information comes into the auction house very close to the sale which will provide insight into buyer interest in the piece. Make sure your reserve is low enough that an auctioneer has the ability to start low to get people excited about bidding on the piece.

- Insurance: The biggest losses tend to occur when the artwork is in transit from your house to the auction house. Have a true insurance value on the piece so that in case of loss you are made whole. Don’t trust the shippers to have appropriate insurance.

- Placement: Make sure that when the exhibition is up for viewers of the sale your work is displayed in a dominant position in the sale room and has good light.

Finally, avoid having your work of art go unsold because that’s not good for its resale value. If you carefully follow the steps above, you should have a successful sale and not get the object back.

As you can see, regardless of the object of value, the selling process can be quite complex, which is why it is a mistake to do it alone. Allow a tangible asset fiduciary to bring expertise to the successful sale of your work of art or collection.

FURTHER READINGS

- Is Art a Good Investment?

- Art & Collectibles: the Rise of Alternative Investments

- Protect Your Investments while Divesting Tangible Assets

WHAT ARE THE “BLUE CHIP” AREAS OF NUMISMATIC COLLECTIONS?

The financial world and the art world effortlessly intersect when it comes to investments in valuable works by “Blue Chip Artists.” “Blue Chip” is a term that originated in finance to describe large and established companies whose stocks have a solid current value and dependable financial future. In the art world, the term has been applied to certain artists who had an established and successful career and predictable, strong and appreciating values for their works on the secondary market. Rothko and Picasso are core examples, where their works are acquired as investments and appreciating tangible assets.

The spotlight is often on significant and recognizable artists of the Modern and Contemporary art market, with both the art world and financial world tracking their sale results and new world records at Sotheby’s and Christies annually. However, quietly and without fanfare, there are incredibly impressive markets for other tangible assets. This includes rare and collectible coins, for which the market of sales and acquisitions surpassed a staggering $4 billion in 2018 alone. Other categories include rare and historical manuscripts, collectible cars and luxury time pieces.

What are the “Blue Chip” areas of numismatic collections? Blue Chip coins, like stocks, are examples that have demonstrated long-term investment security and growth. For coins with numismatic value, which have value surpassing their intrinsic or material value, value is often tied to rarity and grade.

Some of the areas in numismatics which are considered blue chip due to their appeal to serious collectors and a strong and steady value appreciation are the following:

EARLY GOLD

“Early Gold” refers to any gold U.S. coins minted between 1795 and 1839. The first gold coins were introduced in three denominations: the $10 eagle, $5 half eagle and $2.50 quarter eagle. The denominations weren’t printed on the coins, but value was based on its weight, with the $10 eagle being equal to ten silver dollars. These early United States gold coins are coveted by collectors and investors for their historical importance, rarity and value. The most coveted and valuable are high-grade uncirculated examples that can sell into the millions of dollars. One of the most valuable coins in this group is the finest example of the 1795 Draped Bust Gold Eagle which had a mintage of 5,583 coins. However, experts suspect that only 10% of these coins survived. The finest example, part of the D. Brent Pogue Collection, sold for just over $2.5 million in 2015 at Stacks Bowers.

KEY DATES

Coins are produced in certain quantities or mintages each year, with certain dates or particular mint locations being scarcer than others due to only a small number of coins either being minted or a change in production resulting in the original mintage being melted, with only a select few being retained. For U.S. coins, the particular coins produced in a certain year where the mintage or surviving coins is small are referred to as “Key Dates.” These particular coins are some of the rarest in the numismatic world. They tend to sustain and appreciate in value as they are always sought after by serious collectors and investors who have a need to complete a collection. One of the most valuable of these key date coins is 1907 rolled edge Indian $10, which has doubled in value over the last 20 years, consistently selling close to $200,000. The value is due to the original mintage of 31,500 coins being held back before release and melted down. It is suspected under 50 coins were retained for archival purposes.

PROOF GOLD COINS

Proof coins are a limited number of coins produced by a mint to check the dies. U.S. mints began producing proof coins in 1820. In some years only 100 proofs were produced. They can be identified by their shiny surfaces and sharp crisp details and edges. Proof coins are rare and valuable, and coveted by collectors. Due to their limited mintage and the steady appetite of new collectors, the values for the early gold proofs has only increased. One of the more valuable proof coins is the 1907 Saint-Gaudens Gold Double Eagle Ultra High Relief. Then President Theodore Roosevelt had ordered the coin to be re-designed where the relief decoration would be much higher than usual. The mint attempted the high relief; however, the process was complicated and ultimately it was deemed not efficient for mass production. The design was eventually lowered, but in the short term a few ultra-high relief proof coins were produced. These proofs consistently sell above $2 million at auction, with the finest examples selling close to $3 million.

Serious numismatic collectors and investors tend to focus on these three collecting areas due to the significant rarity and the long-term investment that goes with that. With a fixed and limited supply of these early minted coins and demand ever increasing, the investment opportunity is solid and established.

FURTHER READING

- Insider Look at Fine Art, Wine & Trading Cards

- Art & Collectibles: The Rise of Alternative Investments

THE STATE OF THE ART MARKET: SPRING 2019

2018 was a very busy year for both auction houses and the private sector, with global art market sales reaching $67.4 billion up 6% year-on-year.[1] Auction houses and larger galleries are prospering in this market, leaving smaller and mid-sized galleries behind and increasing the disparity between these large and small organizations. Fewer galleries are opening and more are closing as bigger gallery names consolidate both artists and clients.[2] Museums and dealers alike are focusing their attention on diversity and inclusion, highlighting artists of color and women who are experiencing increased exposure in exhibitions leading to an increase in market demand. 2018 was a record year in terms of sales volume and Postwar and Contemporary art remained the leader, followed by Impressionist and Modern. [3]

The art market is not protected from uncertainty and functions like other big markets. In 2016, all major markets declined due to economic and political uncertainties damaging market confidence, with sales losing 16% of their value in the years 2014 to 2016.[4] By 2017, the environment of the market improved for sales with stronger consumer confidence and increased supply at the top of the market. The market realized a powerful and positive gain of 12% in 2017 with the auction sector outperforming the dealer sector. While the mood of the art market in 2018 was slightly less hopeful due to larger economic and political issues impacting investor and consumer attitudes, it did not stop people from buying. More risk-averse buyers and sellers moved into private sales within the dealer market, which experienced a 7% growth in 2018. The auction market advanced by 3%, and there was additional e-commerce growth. [5]

The majority of growth at auction continued to be focused on the top end of the market, leaving the middle and lower segments to be stagnant or declining, a trend reflected in the dealer market as well. In 2018, sales in the auction segment (including both public and private sales auction houses, both on- and offline) constituted 46% of the market, down 1% year-on-year. The dealer segment (including dealer, gallery, and online-only retail sales) made up the remaining 54% of the market.[6] Sales at public auction of fine and decorative art and antiques (excluding auction house private sales) reached $29.1 billion in 2018, an increase of 3% year-on-year, and up nearly 30% over 2016; dealer sales in 2018 reached an estimated $35.9 billion, up 7% year-on-year.[7] The global art market continues to be dominated by the US, UK and China, with their combined sales accounting for 84% of the global market’s total value.

The art world continues to be globalized, bringing in more success for auction houses and larger galleries alike, impacted greatly by technology. Increased integration between technology and the art world has led to a greater flow of information globally, allowing buyers to access images and information on works instantly. Technology is actively influencing how buyers are making decisions and is even going so far as to impact art-making with AI. This has led to the increased importance of online sales; in 2018, global sales in the online art and antiques market reached an estimated $6 billion, up 11% year-on-year.[8]

In 2018, art fairs continued to be a crucial aspect of global art sales and act as a central part of the livelihoods of many dealers. There were around 300 fairs with an international element in 2018, and art fair sales were estimated to have reached $16.5 billion in 2018, a rise of 6% year-on-year. [9]

Over the past decade, sales have generally reached a much higher level making it increasingly hard to establish and maintain continued high levels of growth, especially when coupled with a supply-limited art market. The volume of sales as measured by the number of transactions increased at a slower rate compared to values, growing only 2% year-on-year. The number of transactions reached its highest level since 2008 at an estimated 39.8 million, led primarily by increased sales by dealers in the online sector with fine art auction declining slightly for the second consecutive year. [10]

SEGMENT TRENDS

Contemporary art continues to dominate with booming sales and growth across the board.[11]

Post-War and Contemporary art was the largest sector of the fine art auction market in 2018, accounting for 50% by value and 47% by volume. Reaching sales of $7.2 billion, Post-War and Contemporary art realized an increase of 16% year-on-year, despite a minimal drop in the number of lots sold by 5%.[12] Currently, the Contemporary market is experiencing a big push for both artists of color and female artists. These underrepresented groups are gaining more attention, and specifically there is a growing interest in abstract expressionist female painters. In 2018 the US remained the global center for Post-War and Contemporary art. Looking East, China maintained its spot in second place. The growing Asian market for Post-War and Contemporary art recently has focused on younger, contemporary artists such as Banksy, Kaws, and Jonas Woods. Furthermore, globally, there has been a revival of interest in established artists from the 1960s and 1970s, with more inclusion of female artists and artists of color. Following another strong year of growth in 2018, the value of Post-War and Contemporary art increased by 63% in the past decade from 2008 to 2018.

After Contemporary sales are Impressionist and Modern sales. Behind the Contemporary sector, in 2018 the Modern art sector was the second largest in the global fine art market with a share of 29% by value and 31% by volume. Following two years of strong growth, in 2018 Modern art sales were $4.3 billion despite a decline of 10% in the volume of transactions. [13] Demand for Picasso paintings from the 1960s is as high as ever, as is interest in key members of the Surrealist group, in particular René Magritte and Joan Miro. Behind Modern art is the Impressionist and Post-Impressionist market, a sector which has had mixed performance over the past decade. The sector had a share by value at 15% in 2018, a slight decrease from 17% in 2017. The Impressionist and Post-Impressionist sector constituted 14% of the share in the number of global fine art lots sold at auction.[14]

The smallest of all the sectors in the global art market is Older Master and European Old Masters. Accounting for 6% share of the value of the fine art auction market in 2018 (down 3% from 2017), Old Masters made up 8% of the number of transactions in the fine art auction market. In 2018, the sales of all Old Masters works fell right below $905 million, a 31% decline in value year-on-year. This decline can be partially attributed to the outlier lot in 2017. The sector’s market has declined over the last 10 years, with values at their lowest point after falling 9% since 2008.

FURTHER READING

- State of the Art Market: Insights Into the Spring 2022 Auction Season

- Looking Forward: Ten Art Market Predictions for 2023

- Spring Art Market Recap 2022

Bickar, Betsy. State of the Art Market: Spring 2019. Report no. Spring 2019. April 17, 2019. Accessed July 23, 2019. https://www.privatebank.citibank.com/pdf/State-of-the-Art-Market-Spring-2019.pdf.

McAndrew, Clare, Dr. The Art Market 2019. Report no. 3. Accessed July 23, 2019. https://www.ubs.com/global/en/about_ubs/art/2019/art-basel.html.

[1] McAndrew, Clare, Dr. The Art Market 2019. Report no. 3. Accessed July 23, 2019. https://www.ubs.com/global/en/about_ubs/art/2019/art-basel.html.

[2] Bickar, Betsy. State of the Art Market: Spring 2019. Report no. Spring 2019. April 17, 2019. Accessed July 23, 2019. https://www.privatebank.citibank.com/pdf/State-of-the-Art-Market-Spring-2019.pdf.

[3] Ibid.

[4] McAndrew, The Art Market 2019. Report no. 3.

[5] Ibid.

[6] Ibid.

[7] Ibid.

[8] Ibid.

[9] Ibid.

[10] Ibid.

[11] Bickar, State of the Art Market: Spring 2019. Report no. Spring 2019.

[12] McAndrew, The Art Market 2019. Report no. 3.

[13] Ibid.

[14] Ibid.

ART & INNOVATION AT CHELSEA & WESTMINSTER HOSPITAL

We are delighted to have sponsored The Healing Arts, a collection of essays delving into the story of the arts and Chelsea and Westminster Hospital, from the pioneering arts and design programme to the hospital’s impressive art collection.

Spearheaded by the team at the hospital’s charity CW+ the innovative art and design programme combines live performance, workshops and technology to transform the hospital environment for the patients, their families and staff.

Trystan Hawkins, CW+ Arts Director, commented: “The Healing Arts celebrates the legacy of the arts programme founders at Chelsea and Westminster Hospital, demonstrating how their vision allows us to continue to innovate by commissioning ambitious, bold and daring contemporary art and design that has profoundly positive impacts on patients, staff and visitors. We are incredibly grateful to our community of supporters, who make our work possible.”

The hospital’s art collection is funded, curated and managed by CW+ and has over 2,000 artworks, including a Veronese in the hospital chapel and monumental Allen Jones in the atrium. The fact that many of the donations come from local artists, such as Patrick Heron, Mary Fedden and Eduardo Palozzi, cements the collections position in the community.

Philip Hoffman, our CEO and a member of the CW+ Development Board says “Art serves many purposes, often to communicate, to emote, to create a sense of beauty or to motivate; but within the walls of Chelsea and Westminster Hospital it plays another vital role. Art goes above and beyond, and instead becomes a tool for healing.”

Read more about CW+’s incredible work and The Healing Arts here.

We asked our Jewelry Advisor Raymond Sancroft-Baker to give us his top tips on buying and collecting jewelry.

FIRST QUESTION

When you are thinking of buying a piece of jewelry or a gemstone you must ask yourself two questions, ‘Do I like it’ and ‘Can I afford it’, if the answer is yes to both, go ahead and make the purchase.

BUY QUALITY

I would then look for the best quality jewel I could afford. So often people have bought lots of minor pieces ‘because they were cheap’. There will always be inferior items for sale but jewelry of real quality is rare and always will be. Remember the best gets better. Of course, price is always a consideration but it is preferable to purchase four or five good jewels rather than ten ordinary pieces.

WHERE TO BUY: RETAIL

Walking down Bond Street there are numerous retail jewellery shops to visit. Graff will show you the finest diamonds and gemstones available. Cartier, Van Cleef & Arpels, Boucheron and Tiffany will be able to offer you a broad range of contemporary jewellery as well as a small selection of their vintage pieces. You will see a very wide range of jewels from the low thousands to the high millions. There will be an extensive choice and the benefit of immediate purchase, but you will be paying retail prices as having a shop on Bond Street is very expensive.

WHERE TO BUY: AUCTION

Alternatively, if you go to an auction house to buy your jewellery you will have limited choice. Sometimes there is a good selection from a deceased estate (the family will retain the most wearable!), or someone is elderly and has no occasion to wear their jewellery. Christie’s, Sotheby’s and Bonhams all have auctions and offer a wide selection of gems and jewellery from different periods to choose from. The prices will be lower than retail but make sure you understand exactly what you are buying and look at the condition report as well as asking the specialist their opinion.

INVESTMENT

There is always an implication in the word ‘investment’ that values will rise, I prefer to call jewelry a ’store of value’ and over time good pieces bought at the right price will keep pace with inflation. If you buy retail you will have to wait many years to get your money back and at auction there are fees when buying and selling so it is important to like and hopefully wear, the jewelry you purchase.

VINTAGE JEWELRY

If you like a particular style, be it Belle Epoque or Art Deco make sure that the piece in question is actually from the period. There are a number of clever imitations on the market that can easily fool the layman. So make sure the vendor states in writing that the piece they are selling is Belle Epoque circa 1905 or Art Deco circa 1930. Jewelry from these eras will always display some natural wear and have a soft feeling as opposed to new pieces that will be rather sharp in the hand.

CONDITION REPORT

It is always advisable to request a condition report whether you are buying from a dealer or an auction house. This should give you a complete picture of the gemstone or jewel as it is important to know exactly what has happened to the item. Small changes like ring sizing or minor repairs are normal but major alterations could make re-selling difficult.

CERTIFICATES

Nowadays, more than ever, it is essential to obtain a gemmological report if you are buying an expensive gemstone or piece of jewelry. Pearls are notoriously difficult to judge if they are natural or cultured so it is imperative to have proof that they are natural from a recognized laboratory. Rubies, sapphires, emeralds and pearls should have a report, ideally from the SSEF (Swiss Gemmological Institute) in Basel or Gubelin in Lucerne. The same principle applies to diamonds and the foremost laboratory is the GIA (Gemological Institute of America).

SIGNED JEWELRY

It is certainly preferable to buy a signed piece of jewelry as it inspires confidence that it has been made to a certain standard and that the stones used in its manufacture are superior to a similar but unsigned piece. Some will be numbered as well as signed which means that it could be traced back to it’s place and year of manufacture. A jewel by Cartier from the 1930s is certainly worth double an unsigned piece and this can be justified by knowing one is buying good design, excellent color combination and of quality manufacture.

COMPARISONS

Finally shop around, there will be many people wanting to sell to you and there are lots of places to visit. Grays Market at 58 Davies Street has numerous jewelers as does Burlington Arcade apart from the well-known brands along Bond Street. And one final piece of advice, don’t be tempted to buy treated stones or synthetic diamonds – however cheap they might seem.

Let Our Advisors Assist You this Father’s Day

Let The Fine Art Group assist you with finding the perfect gift for Father’s Day. Our Art Advisory team reviews art fairs and all major auction and dealer catalogues. We are positioned to be able to source the rare and unique, whether it be jewelry, fine art, wine, rare books or other decorative arts.

American Art & Pennsylvania Impressionists

June 9, 2019

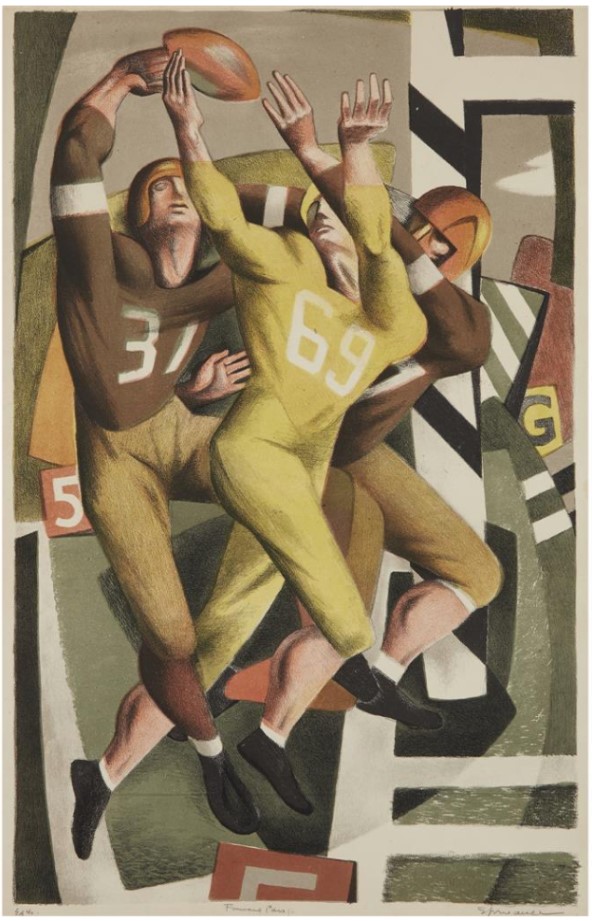

Benton Murdoch Spruance (1904–1967)

Forward Pass

1944

Edition of 40.

Pencil signed ‘Spruance’ bottom right; also titled bottom center and inscribed ‘Ed. 40’ bottom left

Color lithograph (with five colors) on paper

Image size: 20 1/16 x 12 1/2 in.

Sheet size: 23 x 15 5/8 in.

Printed by Cuno.

[Fine/Looney 231]

Estimate $3,000-5,000

PROVENANCE

Private Collection, Philadelphia, Pennsylvania.

Exclusive Watches Sale

June 6, 2019

Rolex

GMT-Master Ref. 1675 in Steel

1967

Ref: 1675

Case Number: 1830596

Case Material: Stainless steel

Case Dimensions: 40 mm in diameter

Dial: Black with luminous hour markers, date aperture at the “3” hour marker

Bracelet Material: Rolex signed ref. 78360 in stainless steel

Bracelet Size: 6 3/4 in.

Movement: Automatic

Functions: Time, date, GMT

Caliber: 1575

Estimate: $5,000

Finest & Rarest Wines Sale

Petrus 1992, Pomerol

Excellent levels and appearance, WA 90, 8:5 bts (owc)

Estimate Per Lot: $6,500-$8,000

Fine Books and Manuscripts

June 13, 2019

John Fitzgerald Kennedy (1917-1963)

Profiles in Courage

New York: Harper & Brothers, 1961.

Estimate: $2,000-$3,000

The David Gilmour Guitar Collection

Lot 6

Gibson Guitars

GIBSON INCORPORATED, KALAMAZOO,

1973

A Solid-Body Electric Guitar, Les Paul

Estimate: $2,500-$3,500

NOTE

Orville Gibson, who in 1894 worked as a part-time shoe salesman and restaurant clerk in Kalamazoo, Michigan, possessed a dual passion for music and woodworking. Although Gibson lacked any formal training as a luthier, it was his creative thinking, at the nexus of these two passions, which convinced him that he had the means to greatly improve guitar construction.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

COLLABORATION WITH INTERIOR DESIGNER PATRICK SUTTON

Our art advisory team is honored to work with Patrick Sutton. Patrick is an international acclaimed interior designer and story teller whose interiors convey a sense of refined luxury.

“Baltimore-based interior designer Patrick Sutton grew up touring the world with his travel journalist father and fashion model mother. The golden light of Rome, the colorful spices of Marrakesh, the polished marble floors of a Paris hotel: the young voyager developed a vivid visual library of the world’s beautiful spaces. Following his love of design to a career in architecture and interiors, Sutton today draws upon this store of memories to craft unique designs intimately related to his clients and their dreams.”

The Fine Art Group congratulates Patrick on the publication of his first book Storied Interiors which focuses on high end residential interiors as well as public spaces such as the Sagamore Pendry Hotel in Baltimore, MD which was recently rated as the Number One Hotel in North America by Condé Nast.

Have you recently inherited a piece of jewelry or art that is not yet insured? It’s also possible that the worth of a valuable you own has increased over the years without your knowledge, and it’s no longer adequately protected by your policy.

I cannot stress enough that appraising your valuables is critical for securing adequate insurance. But how do you go about having the appraisal done? Read my interview with Colleen Boyle of The Fine Art Group below. With over 20 years of experience in the art and financial world, she shares her views on the importance of appraising your valuables to secure adequate insurance coverage and how to find a qualified appraiser.

Q & A WITH COLLEEN BOYLE

WHY IS THE APPRAISAL OF ANY VALUABLE IMPORTANT?

Having adequate insurance coverage—An appraisal process will help you identify what you own, know the value, and document your valuables in the form of either a visual inventory (photographs/videos), a written report, or a combination of both. This is extremely helpful, if not a must, to adjust your existing contents coverage within your Homeowners policy or to select sufficient insurance coverage for all your items so you can be made whole should a loss occur.

To demonstrate my point, here’s an example. The Fine Art Group conducted an appraisal for a client of mine who had a total contents coverage at $250,000. As a result of the evaluation, we discovered they had a little less than $1 million worth of books and manuscripts—they had absolutely no idea they were worth that amount of money. They scheduled some of the valuables on their insurance policy, and they also increased their contents coverage on their Homeowners’ policy to cover all the other items in their house (furniture, decorative items, etc.). Approximately a year and a half later, that client had an electrical fire. Because they had proper visual and written documentation of all of their lost valuables, it helped make the claims process more efficient, and they were reimbursed for everything they had lost in the fire.

HOW DO YOU SELECT THE RIGHT APPRAISER?

Work with your insurance advisor to select an appraiser that fits your needs; your advisor might even already have a trusted relationship with a reputable appraiser. This relationship will provide you with more comprehensive protection all around, because it takes both a proper appraisal and a strong policy to protect your valuables. When your insurance and appraiser professionals work together closely, they are more likely to catch gaps in coverage and value changes.

For instance, a client of mine wanted to make sure their Andy Warhol screen print scheduled on their insurance for $22,000 was protected during their move. The Fine Art Group reviewed the schedule, and it turned out the piece was actually worth over $200,000. We recommended that the piece be revalued at the current retail replacement value, and we worked with the insurance advisor to have the client’s current policy changed to reflect the correct value so that it would be protected during transportation.

WHAT QUALIFICATIONS SHOULD A GOOD APPRAISER HAVE?

Here are six selection criteria to consider:

- Industry recognition: I highly recommend selecting an appraiser who is a member of at least one of the three industry associations (Appraisers Association of America, International Society of Appraisers, and American Society of Appraisers). These associations have strict criteria for accepting new members, and they require annual continuing education to keep current.

- Certification: A good appraiser should also stay up-to-date on their USPAP—an exam taken every other year that keeps appraisers current on tax law changes, updates in IRS appraisal requirements, and insurance market developments.

- Specialized expertise: Many appraisers don’t have deep expertise in every valuable you might have. But, it behooves you to find an appraiser who specializes in knowledge of multiple valuables (jewelry, art, antiques, wine collection, sports memorabilia) so you are receiving an accurate evaluation and recommendations for protecting all of your different assets.

- Security: If an appraiser is coming to your home, would you be concerned with your privacy and security? Only a few companies address this concern. For instance, at The Fine Art Group we conduct background checks on our appraisers, and we also send a bio and a photograph of the appraiser to you prior to the appointment. This is not a standard process, so be sure to select an appraisal company that makes you feel comfortable.

- Confidentiality: Although non-disclosure agreements are important for people who are concerned with confidentiality, they are not offered by all appraisal companies. Make sure to work with an appraiser that ensures your information won’t be shared with anyone, including attorneys, wealth advisors, and fellow coworkers, without your express permission.

- Fiduciary and advocate: Appraising is more than just a transaction. A good appraiser serves in a fiduciary role protecting your best interests when providing guidance on handling your valuables and ensuring you have proper insurance coverage. For example, at The Fine Art Group we protected the interests of one of our clients by identifying the best international auction house where their artwork would sell for the most money (which was overseas), and then also helped ship the piece.

If you have any questions about selecting the right appraiser or evaluating and insuring your valuables, contact me at john@psafinancial.com.

ABOUT THE AUTHOR

Joining PSA in 1981, John Lannon, vice president, is the longest tenured account executive, with 34 years of service and is consistently ranked as a leading personal lines broker at PSA. John was instrumental in launching PSA’s Private Client Group, catering to the affluent market, bringing together the elite insurance carriers in the industry for the implementation in regional, national, and worldwide scenarios.

Read the entire article at Personal Insurance.