Our team understands the complex and varied needs of institutional and corporate clients. Between our Appraisal and Advisory departments, we can create bespoke plans, working within institutional missions and processes to ensure their collections are properly insured, protected and cultivated.

We are proud to have advised the Carnegie Library of Pittsburgh over the last few years to ensure that their beautiful rare book collection is appropriately insured and worked with law enforcement on the recovery of many volumes for the city of Pittsburgh.

“In the fall of 2016, library officials decided it was time to audit the collection again, and hired the Pall Mall Art Advisors to do the appraisal. Kerry-Lee Jeffrey ….. began their audit on April 3, 2017, a Monday, using the 1991 inventory as a guide. Within an hour, there was trouble. Jeffrey was looking for Thomas McKenney and James Hall’s History of the Indian Tribes of North America. This landmark work included 120 hand-colored lithographs, the result of a project that began in 1821 with McKenney’s attempt to document in full color the dress and spiritual practices of Native Americans who had visited Washington, D.C. to arrange treaties with the government. The three-volume set of folios, produced between 1836 and 1844, is large and gorgeous and would be a highlight in any collection. But the Carnegie Library’s version had been hidden on a top shelf at the end of a row. When Jeffrey discovered why, her stomach dropped. “Once a plump book filled with plates,” she would recall, “the sides had caved in on themselves.” All those stunning illustrations had been cut from the binding.”

Read more at Smithsonian Magazine

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

THE ART MARKET & COLLECTORS IN 2022

Reinvigorating the ‘heat’ and associated public relations noise around the global calendar of auctions and commercial exhibitions is one key challenge facing the art market in the medium to long term. Another is the covid associated disruption to a huge variety of ostensibly non-commercial activities which are often the art historical engines propelling value growth for young, old and dead artists alike.

The Venice Biennial, for example, has been moved to 2022. While the 2020 Turner Prize will now comprise a proportionate cash prize to ten shortlisted artists rather than announce a single winner. Museum exhibitions around the world have also been put on hold (although some are now beginning to reopen) which further softens the positive impacts that might have been elicited by institutional solo exhibitions, major monographic surveys or permanent collection acquisitions. Many institutions are also now fighting for survival. With drastic cuts to exhibition budgets or outright closures, the art historical and intellectual capacity of the visual arts ecology may well contract markedly in the next twenty-four months.

Understanding the impacts this may have on market trends and values remains to be seen. Several trends at lower price points were especially evident pre-covid – figurative painting by mainly female artists addressing identity politics, for example – while artists at the other end of the spectrum, such as Alex Katz, were enjoying major late career market jumps.

Recent auction results have shown collectors’ predisposition to proven names at sensible prices. But the new stars of tomorrow, the long forgotten late career artists ripe for ‘rediscovery’ and the next hot artist estates will not be anointed in 2020, or perhaps even 2021. Collector tastes may also change as they invariably do following seismic global changes. Look, for example, at the market of Anselm Reyle. Eight of his top ten auction records were achieved in 2007 – 08 in the heady, frothy days before the economic crash of 2008 – 09. His market has since dived in value and is only just beginning to recover. Given the current situation might take twelve, eighteen or twenty-four months to solve itself globally, tastes may shift significantly before they begin to make themselves apparent in the galleries and salerooms.

With the art world – to an extent – preserved in aspic at a moment from February 2020, it may not be until the summer of 2022 that we see a global visual arts ecology establishing and validating financial and art historical value in a fully functioning manner at all levels as it was before.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Image courtesy La Biennale di Venezia; Image 2: Image courtesy BBC News; Image 3: Image courtesy Phillips

FURTHER READING

- Why Serious Collectors Need Professional Collection Management Services

- El Niño 2023: Are Your Art & Collectibles Protected?

- Market Update: How the Art Market Joined the Digital Age

With galleries, auction houses and shippers temporarily closed, the art world has adapted fast to bring art onto our screens at home, recreating exhibitions, studio and canvas in the virtual world. Of course, some projects have been in development for some time, but current circumstances have accelerated the delivery of these products, whilst other platforms have long existed but are seeing greater transactional flow. We look at a selection of these developments, how their user experiences compare, and what they could mean for the future of how we transact in the art market.

ART FAIR

The first iterations of our new digital involvement with art began with Art Basel Hong Kong’s online viewing rooms, initially organised due to the political problems faced in the region but by the time it came to its opening date, a necessary installment to initiate the fair. Unsurprisingly the site crashed in its first moments, testament to the popularity of the Basel brand, but was soon up and showcasing viewing rooms of up to ten works per gallery. Specific retail prices or large pricing brackets could be shown, the latter requiring an inquiry to find out more, which hindered what could have been greater price transparency for the fair. Some presentations, including those of Lisson & Pace, offered a zoom walk through explaining their booth which worked with some effect to bring the works to life. Galleries varied in the quality of their viewing rooms with some offering installation and scale images, whilst others had just single images which felt like a jpeg slide show. Overall the fair reported some significant sales, not only offering hope for online transactions but also paving the way for other players, galleries and art fairs alike to take things online, faced with the reality that our sector was globally shutting down for a significant period of time.

Dallas Art Fair ensued, which largely followed that same format but offered galleries the chance to hide prices. There was also no zoom function which made assessing images increasingly difficult without requesting high res images from galleries – perhaps a way for trade to facilitate direct enquiries? Nevertheless, taking Dallas online has given global access to a smaller, less visited fair that we might not otherwise encounter IRL and highlights the increasing global connectivity that online access affords. Frieze New York will be the next major instalment of an online fair at the beginning of May and it will be interesting to note how they might have been able to profit from the do’s and don’ts of these earlier fairs.

AUCTION

Auction houses have long had a digital commercial presence, but unsurprisingly are shifting consignments to additional online sales. 21st April saw Sotheby’s highest ever online sale total with their Contemporary Curated London auction bringing in £5.1 million ($6.4m), sailing past its pre-sale high estimate of £4.7 million ($5.75m). It also included the highest price ever paid for an artwork in an exclusively online auction; George Condo’s 2005 canvas selling for £1 million ($1.3m) against a low estimate of £800,000. A positive signal that whilst these times are financially challenging for art businesses, transacting online is a viable revenue resource, even at higher price levels – a trend The Fine Art Group’s Managing Director, Guy Jennings, suspects will continue, “if this lasts six to nine months, people will become more relaxed about buying online at a higher level,” as quoted in The New York Times last week. Whether online sales continue in strength post-pandemic will remain to be seen.

GALLERY

A couple of weeks prior to the auction, Condo’s online show at Hauser & Wirth, his first with his new gallery, sold out before it even launched onscreen. Bidding for the Sotheby’s work was perhaps prompted by those who missed out on the primary works on paper priced between $100,000 and $125,000, inspired by isolation.

The blue-chip galleries have all differed in their approach to the situation. A number of galleries have opted for online exhibitions of shows that were due to open, if they have been fortunate enough to have been able to photographs works. Stephen Friedman’s latest exhibition of Andreas Eriksson included a virtual gallery space which you could move through to experience the works hung together; whilst a little rudimentary, it certainly offered a sense of scale and context for the pieces that can’t be found in a mere PDF.

Pace and David Zwirner have opted for more curatorial approaches, presenting online exhibitions in a holistic way, creating multimedia environments with artist created content, embedded videos and longer excerpts of art historically relevant material to contextualise their shows. Zwirner is also opting to use its position and power as a platform for younger or smaller galleries perhaps hardest hit by these recent times. Gagosian has avoided taking their scheduled exhibitions online as ‘that’s not how they were conceived’ according to the gallery’s owner Larry. Instead they are opting for their ‘Artist Spotlight’ series which invites a different artist to take over the gallery’s editorial and social media channels and transform them into a new multifaceted online platform for presenting a single artwork each week.

Most excitingly this period has seen an expeditated release of new technologies and apps that were in the pipeline but have now been forced into early fruition. These are notably being generated by the big blue-chip galleries with the ability to put their weight and capital behind these costly projects – which smaller galleries lack the resources to produce. Lisson Gallery has just launched its initiative with the software company Augment. The platform has been in development for the past year and a half and allows user to begin “placing” one of 100 available works into their own personal environments; not only easing the experience for clients but also businesses, enabling them to avoid the cost and travel implications of shipping works for consideration.

Massimo de Carlo has also just launched Virtual Space, or VSpace an immersive walkable experience accessed via their website or a VR headset. The inaugural show features works conceived especially for the virtual platform by artists John Armleder and Rob Pruitt.

Certainly not the only other notable tech release in this sector but Oliver Miro, son of gallerist Victoria Miro, has launched a virtual reality app named Vortic, due to be released with a joint exhibition with Victoria Miro & David Zwirner in the next few weeks. The venture offers galleries a subscription-based service with customizable virtual gallery spaces wherein they can show their art using virtual and augmented reality technology. The product is divided into two apps Vortic Collect and Vortic VR, the latter designed for use with a VR headset if owned, the former offering a virtual space.

With such a slew of new ways to experience art at home it remains to be seen which will stand the test of time. However, it has been a useful exercise to view art in a different environment, without a crowd or unaccompanied by in person salesmanship, with more room for careful consideration and time for contemplation. And despite some of these online initiatives working more effectively than others, it is testament to the art world’s resilience and the ever-creative methods industry traders are employing in an effort to keep their businesses going.

Critics and dealers are citing this as accelerating changes that were already taking shape in the industry, predicting a future where digital, online exhibitions become more frequent and physical art fairs reducing. Will this become the new normal? Digital developments help with accessibility, to widen audiences and connect an increasingly globalised art world; but we ourselves wait with bated breath for the moment we can experience art in the flesh again. These new platforms will provide an excellent accompaniment to transacting in the post COVID environment; however, we feel they will always remain in tangent with physical encounters to art, as opposed to replacing them altogether.

Further Reading

DESKTOP APPRAISALS

The “desktop” indicates the appraiser provides a value based on information that is provided at the appraiser’s desk. Clients or their advisors can send electronically, via mail or direct upload, the relevant details which will be placed in our proprietary collection management system and valued by our appraisal team.

In order for our appraisers to conduct a remote appraisal, please provide our administrative team with cataloguing information and photographs.

Click here for a downloadable list of requirements for a desktop appraisal.

Once we have the essential information, our appraisers will provide you with a value and a pdf appraisal document.

The Fine Art Group can provide desktop appraisals for any asset.

REQUIREMENT FOR A DESKTOP APPRAISAL

ART APPRAISALS

- Name of artist

- Measurement inside the frame (sight)

- Photograph of entire painting, signature, back (if possible), all receipts or gallery labels

- Medium (for e.g. oil on canvas, oil on board, print)

- Ownership and purchase history of the artwork

JEWELRY APPRAISALS

- Name of brand/designer

- Description of jewelry

- Photograph of jewelry from various angles (including stamps, engravings, stones)

- GIA report

- Ownership and purchase history of the jewelry piece

OTHER VALUABLE ASSETS

- Photograph of object

- Dimenions of objects

- Ownership and purchase history of object

Virtual Consultations

For prospective clients that have some technological awareness, The Fine Art Group can organize virtual visits to discuss what clients own to determine the appropriate risk management strategy.

The Fine Art Group provides complimentary schedule reviews to make sure that clients are insured appropriately and insight into only the assets that require reappraisal.

Contacts

Western region – Anita Heriot, President

Eastern & Midwest region – Colleen Boyle, SVP & National Sales Director

South East region & Gulf Coast – Shane Hall, Senior Advisor & Appraiser

Appraisal inquiries – Kate Molets, Director of Appraisals

The Fine Art Group offers bespoke advisory services for all tangible assets.

We have preferred terms for several select categories where we have identified specialty selling venues that consistently have the highest results for the particular object.

Our experienced team of advisors conducts full market analytics on the object to determine the best method of sale.

- American Art

- 20th Century Design

- Numismatics

- Fine Jewelry & Watches

- Native American Art

- Fine Books, Maps & Manuscripts

- Entertainment & Sports Memorabilia

- Western Art

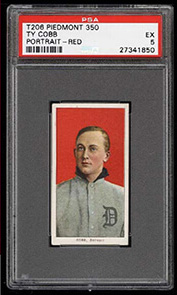

- Baseball Cards

CASE STUDIES

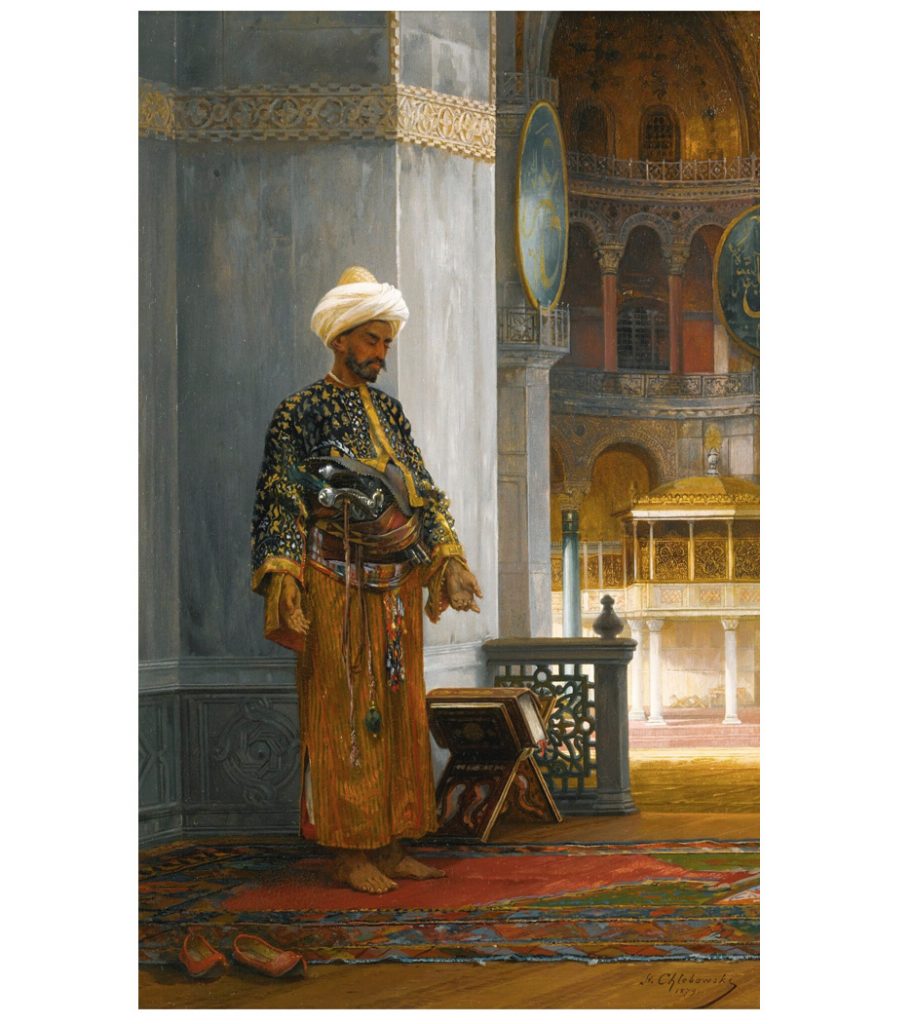

If selling at auction we ensure it is sold in the correct specialty venue to net the highest return. An example of this is highlighted below. This work sold for $50,000 in a general Fine Arts sale. When re-offered a year later in the appropriate annual Orientalist sale in London it sold for $179,000, more than tripling its previous result.

Stanislaus von Chlebowski

At Prayer, Hagia Sophia

Oil on panel

18 x 12 in.

Pall Mall Art Advisors follows the market for all tangible assets including fine jewelry. We alert our clients on when is the best possible time for sale. The market is especially responsive right now for colored diamonds.

Unmounted Fancy Intense Orangey Pink Diamond

Estimate: $100,000-$150,000

Realized Price: $200,000 (with Buyer’s Premium)

Further Readings

- Ten Reasons “Going in Alone” at Auction is a Mistake

- 10 Reasons to Work with an Advisor for a Successful Sales Process

The Fine Art Group is honored to be in contention for the Best Lifestyle Management Award at the prestigious Private Asset Management (PAM) Awards 2020.

The PAM Awards exist to recognize the top investment professionals, wealth advisors, legal firms, consultants and other key service providers in the private asset management space.

The Fine Art Group sends our congratulations to all the winners!

At The Fine Art Group, we advise collectors and their financial and legal advisors on the strategic, long-term management of their collections of art, jewelry and collectibles.

Our team understands the complexity of owning, buying and selling tangible assets like no other, allowing us to function as our clients’ advocate at all times.

Whether providing Appraisal, Advisory (Buying or Selling) or Tangible Asset Management services our clients find our team and our network of more than 50 vetted experts to be a trusted resource.

We are a vetted partner with varied institutions such as High Net Worth Banking, Lifestyle, Accounting, Insurance and Wealth Advisors.

In 2020 we celebrate the 20th anniversary of The Fine Art Group. Twenty years ago, I left Christie’s to launch the first institutional art fund. Today I’m proud to say that the Group has grown into a global market leader in the art world with a global team of over 30 professional staff acting for 140 clients in over 20 countries. We have advised and traded over $1.3 billion in value of artworks, with an additional $3 billion of private collections valued in just 3 years. While much has changed in the last twenty years, we’ve always remained true to our company values: offering preeminent art expertise, real transparency, independent, unconflicted, discreet, and innovative services to both the world’s leading art collectors and art novices and focused art investors alike.

LAST YEAR

January marked our much publicised acquisition of London based Falcon Group’s art-secured loan book, strengthening our long-term commitment to being the leading art finance provider to collectors and owners of high-value art globally. The acquisition marked a significant consolidation in the art finance market.

In June, via our Agency business we brought the landmark Maharajas & Mughal Magnificence to auction at Christie’s, New York. After a global tour of six cities and a marathon 12.5 hours of bidding, the collection realised a record-breaking $109,271,875 and was 93% sold.

Throughout the year, we have continually grown our business globally. Now, with representatives in China and Hong Kong, the United States, Switzerland, Germany and the United Arab Emirates, our network of collectors and art professionals is more far-reaching than ever before.

LOOKING AHEAD

As we look to the next decade, I am excited about developing our international art advisory, art agency, art investment and art finance houses. This year will mark the launch of our blue-chip art valuations service.

The Fine Art Group looks very different from the company I founded two decades ago. I am grateful to our exceedingly loyal clients, colleagues, and friends who have supported us from the start.

Yours,

Philip

Not so long-ago January was a dead month in the art world calendar – a collective trade hangover from the autumn season and the slew of dinners in the build up to Christmas. In 2020 it’s an increasingly full month, especially in London. To combat collector malaise associated with a ‘dry’ month – new year resolutions are not conducive to collecting – Condo is now in its fifth London year. Christie’s newly scheduled Modern British sales (on the thin side this season) and the London Art Fair (a localised,entry level event for modern and contemporary art), round off a relatively full few weeks in the city.

Condo has since spawned in New York (2017), Mexico City, Sao Paulo and Shanghai (2019). Condo London reaches across the gallery spectrum, with Sadie Coles, Pilar Corrias and Modern Art among the more established participating galleries. ‘Guests’ for 2020 hail from an incredibly dispersed gallery diaspora: LA, Istanbul, New York, Brussels, Hong Kong / Shanghai, Berlin, Toronto, Chicago, Tokyo, Jakarta, Glasgow, San Francisco, Warsaw, Athens, Mexico City and Vienna. A true microcosm of the so-called global contemporary.

Participation is intentionally cheap (guest galleries pay their hosts a very agreeable £700) and increased footfall the primary objective. The first few days are as close as London gets to a fully-fledged gallery weekend and it’s a remarkably successful way of encouraging gallery goers to traipse across London in the cold and wet. At best, it offers London collectors a chance to discover and acquire works by rapidly rising artists from distant gallery scenes. At worst, presentations are ham strung somewhere between an art fair booth and a true gallery show. Yet Condo is now an essential part of this drab month which is all the better for it.

Looking to the global art fair circuit, the first few months of the year have continued to fill. It’s logical that Taipei Dangdei and Frieze Los Angeles – both enjoying their second iterations – are scheduled for the middle of January and the middle of February respectively. There are few actually quiet moments left and some fairs already encroach on the sacrosanct July-August lull – it’s no surprise that the beginning of the year’s been successfully colonised. Both fairs enjoyed successful first outings in 2019, with Taipei 2020 reporting strong sales and growing, blue-chip roster. While in Barcelona, the art market’s answer to the World Economic Forum in Davos – the Talking Galleries symposium – is now in its eighth year.

It’s hard to imagine what else might fill the slow January weeks in years to come, but for now there’s more to see in London during the first few weeks of the year than ever before.

Images: Installation view, Sofia Mitsola, Darladiladada, Pilar Corrias, London. Courtesy of the artist and Pilar Corrias, London. Photo: Damian Griffiths.

Installation view, Condo London, Southard Reid hosting Öktem Aykut. Courtesy of Ahmet Civelek, Mert Öztekin.

Further Readings

- Spring Art Market Recap 2022

- The Asking Price: Understanding Value #1

- The Asking Price: Understanding Value #2

- Looking Forward: Ten Art Market Predictions for 2023

By Dan Weil, The Wall Street Journal, Published Dec. 15, 2019

Three years ago, Simon Brown, a 36-year-old public-relations professional in Washington, D.C., purchased a 1938 Joe DiMaggio baseball card for $1,500. Its value now: $2,500, up about two-thirds, based on sales records for comparable cards, he says.

That kind of price appreciation is common in today’s sports-memorabilia market, particularly for items priced at $1,000 or more, market participants say. Just as stocks, bonds and other assets have soared in value since the last recession ended in 2009, so has sports memorabilia.

“It’s the same case for collectibles across the board,” says Chris Ivy, director of sports auctions for Heritage Auctions. “Some collectors even view sports memorabilia as an asset class for investment. A lot of our clients love sports and started collecting as kids for a hobby.”

Numerous factors explain the price run-up for sports memorabilia over the past decade, experts say, including the wealth of baby boomers, the entrance of millennials into the market and growing interest from foreigners. Demand for cards and game-used items, such as balls and jerseys, is particularly intense. Of all the sports, the market is generally strongest for baseball items.

Although experts expect the price inflation to continue as long as the economy stays strong, there is no guarantee, just as there are no guarantees with any investment. Making it even more dicey is that there are plenty of bogus and/or overpriced items out there waiting for careless buyers. That’s why it’s crucial for prospective buyers to do plenty of research before taking the plunge.

MONEY AND PASSION

Baby boomers are the foundation of the market because of the wealth they’ve amassed as a group during their careers. “They have huge buying power and nostalgia for sports memorabilia, such as baseball cards and jerseys of their favorite players,” says Anita Heriot, chief executive of Pall Mall Art Advisors, which assists clients with buying and selling all kinds of memorabilia, including sports items.

Meanwhile, Ms. Heriot says she has found that many millennials and members of Generation Z with the money to start collections, especially men, are turning to sports memorabilia because they’re more familiar with sports than they are with art. “That makes it more digestible as a passion and hobby,” she says.

Foreigners are jumping into the market, too, as more people around the world have more disposable income and more athletes from all over the world are achieving global fame in the most prestigious leagues and competitions. For instance, the wave of foreign players who have entered the National Basketball Association over the past 20 years, such as Yao Ming of China and Luka Doncic of Slovenia, has drawn non-Americans to NBA memorabilia, says collector Jimmy Mahan, 43-year-old director of staffing at a North Carolina summer camp. Collectors in China and even in the Philippines—a country with little basketball tradition and no obvious connection to the NBA—have driven prices up, he says.

USED IS GOOD

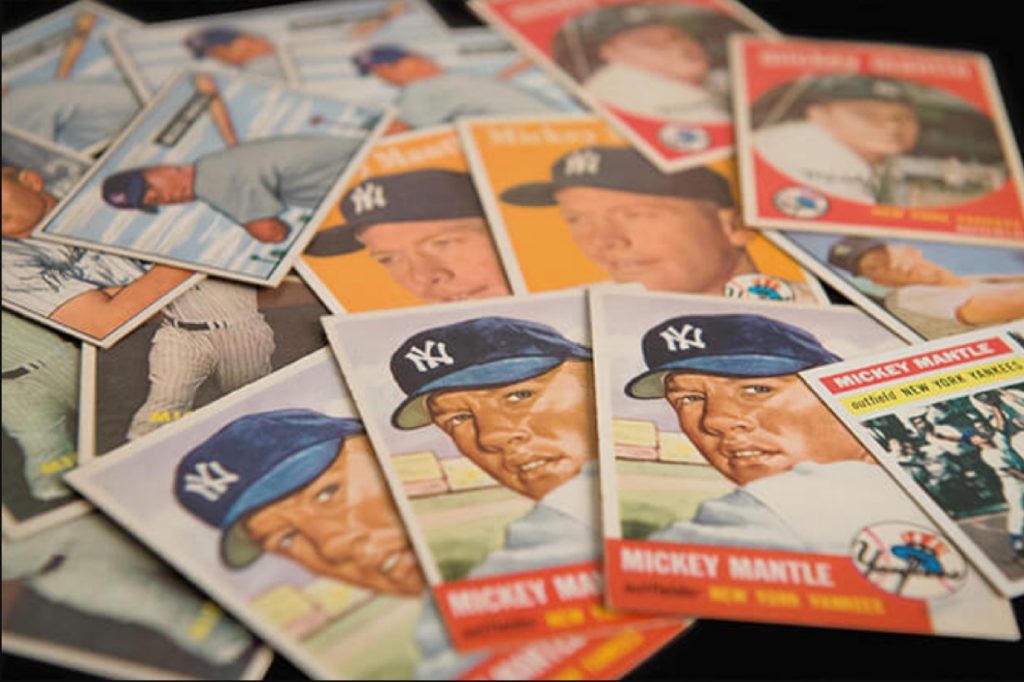

Baseball cards, which originated in the 1860s, remain a staple. Cards prior to 1960 have particularly escalated in value. “A handful of old cards have reached iconic status, such as Honus Wagner cards from 1909-11 and Mickey Mantle cards from 1952,” says Mr. Brown, the collector.

In May, one of those Wagner cards sold for $1.2 million, up 54% from its sale price of $776,750 in 2016 and 83% from its sale price of $657,250 in 2014, according to SCP Auctions, a sports-memorabilia specialist based in Laguna Niguel, Calif. Cards from other sports also have done well. A card of basketball icon Michael Jordan recently sold for $350,000 and a card of football legend Tom Brady commanded $400,000, notes Simeon Lipman, a pop-culture appraiser.

The 1997-98 Jordan card, sold on eBay, came from a set of Metal Universe Basketball Precious Metal Gems cards and is considered one of the most valuable Jordan cards, according to Beckett Collectibles. The card’s condition wasn’t rated, but it was listed as “altered.” The Brady card, which also sold on eBay, came from the 2000 Playoff Contenders Championship Ticket collection. Beckett graded it as being in mint condition.

But cards are starting to take a back seat to game-used items, including balls and jerseys, as collectors seek to get closer to the players and game action. “It’s a popular thing to have a jersey propped on a mannequin in someone’s man cave,” says Jasmani Francis, a consultant to the Winston Art Group, which appraises and advises on collectibles.

In June, a Babe Ruth New York Yankees jersey from 1928-1930 was auctioned at Yankee Stadium for $5.64 million, making it the most expensive piece of sports memorabilia ever sold, according to the auctioneer, Hunt Auctions.

Dennis Riehman, 67, a retired banker in Ossining, N.Y., has a 1927 ball purportedly used in batting practice with autographs from Babe Ruth and Lou Gehrig. He bought it from a family friend who was a Yankee Stadium usher for $2,000 about 25 years ago. A sports-memorabilia dealer told him last year that it was now worth five times that. But Mr. Riehman says the ball means too much to him to ever sell. “I’ll give it to my son.”

DON’T TRUST, VERIFY

So how can buyers, especially novices, avoid overpaying in this inflationary environment? Homework is essential. Buyers can do significant price research with an internet search of dealers, auction houses, appraisers and even eBay. Comparison prices exist on the web for many items, says Mr. Francis, the consultant. That includes sale prices for items comparable to the one a buyer is interested in and sometimes for the same item. Recent sale prices allow buyers to judge whether the current price of the item they want is in line with the market.

Buyers also should research the seller. “Know what it is you’re buying and from whom you’re buying it,” says Steve Sloan, president of Professional Sports Authenticator, which grades and authenticates sports memorabilia. “You should only purchase pieces from a reputable dealer that has been in business for at least five years,” he says. Independent, third-party certification of an item’s authenticity is also important, experts say. Authenticators besides PSA include James Spence Authentication and Beckett Authentication Services. A knowledgeable adviser also might help new collectors avoid costly rookie mistakes.

Despite the potential pitfalls, opportunities abound for collectors of sports memorabilia in a way they don’t for traditional art collectors. “Art is an elite passion,” says Pall Mall’s Ms. Heriot, with prices that run into the thousands even toward the lower end of the market. “But with $100, you can buy a decent sports trading card that will hold value. Sports memorabilia is probably the most populist of passion assets.”

Mr. Weil is a writer in West Palm Beach, Fla. He can be reached at reports@wsj.com.

Read the article on The Wall Street Journal

Further Readings

December is the month of presents, holiday travels, and family time. It is also the time of year when most charitable giving happens! Baby boomers are the wealthiest generation in American history and they’re about to pass down their wealth over the next few decades. A portion of this wealth is in the form of tangible assets that reflect the passions, interests and legacies of the individuals and families who owned them. However, what happens when the heirs are not interested in receiving the gift of art, jewelry, wine, furniture, and other objects that their parents and grandparents have collected over the years?

Art and collectibles can have a tremendous amount of value so you may consider using these items to further your philanthropic interests. Historically most people have donated cash to their favorite charities. Instead of writing checks, some individuals may consider converting their tangible assets such as art, jewelry, wine and other valuable collectibles into a philanthropic opportunity. Using tangible assets in a strategic philanthropy initiative presents families with the chance to work collectively to create a unifying legacy.

WHAT IS TANGIBLE PERSONAL PROPERTY?

Tangible gifts of personal property are defined as personal property other than land or buildings. Items that are included in this category are vintage cars, jewelry, artwork, wine, memorabilia, rare books, furniture, stamp and coin collections, and other types of valuable personal objects.[1]

If you are contemplating a gift of tangible personal property to charity, it is important to be aware of the complex tax issues it can present, which will need to be carefully evaluated by a tax professional in order to maximize your client’s gift and the possible tax deduction.

Below are a few issues to consider[2]:

- Have you owned the donated object for at least one year?

- Will the donated object be used by the charity in its tax-exempt function (related use)?

- Has the Charity agreed to keep the object for at least three years?

- Are you a collector or investor? If your are an artist or dealer, consult a tax advisor to understand the different IRS tax allowable deductions.

- Have you obtained a qualified appraisal for the donated object?

WHAT IS RELATED USE?

According to the IRS tax code, in order for a donor of tangible personal property to be able to take full advantage of a tax benefit, the charity must use the object in a manner that is related to its exempt purpose. Examples would be a painting that is added to the collection of an art museum and a tall case clock created by a regional clock maker given to a historical society. [2]

CASE STUDY FOR RELATED USE

A client has owned a painting for the past 12 years that was originally purchased for $50,000. The client has three heirs of whom none are interested in the painting. The client approached a local museum that is very interested in accepting the painting as a donation. In addition, the painting has appreciated over time and has a current fair market value of $225,000. Since the art museum is planning to keep the painting, the donor can deduct the full $225,000 value of the painting.

If the donor wants to give the same painting to an unrelated charitable organization, the client should consult with their tax advisor. The client may only be able to deduct the $50,000 cost basis. It is the donor’s responsibility to establish “related use,” so the donor should secure from the charity a letter stating the charity’s intent to use the property for a purpose related to its mission.

However a gift of artwork doesn’t necessarily have to be given to a museum to be considered for a related use. For example, gifts of artworks to a religious organization would be considered for a related use if the object would have religious and cultural significance. Similarly, gifts of artworks to a hospital may be for a related use if their display in common and patient rooms contributes to a healing environment.[3]

WHAT ARE OTHER PHILANTHROPIC OPTIONS FOR TANGIBLE ASSETS?

Charitable giving has never only been motivated by tax deductions. Even without the full tax advantage, clients still consider donating to passionate causes by converting their valuable objects into liquidity for a cause they really believe in.For example, a collector sold 800 bottles from his wine collection that had been assembled over three decades. The proceeds were donated to a charity that the collector supports which helps to improve the health and education of children and adults living in rural China.[4]In some cases where the need for a charitable deduction outweighs the importance for minimizing capital gains tax, it may make sense to sell the art, jewelry or other tangible assets, recognizing the income and offset it by making a charitable contribution to a donor advised fund. This allows the donor to possibly maximize their tax situation while unlocking art and other tangible assets for charitable dollars.If the donor contributes appreciated art or other appreciating tangible assets to a public charity (including a donor-advised fund), the collector potentially eliminates the capital gains tax that would otherwise be incurred in a sale resulting in more to give to charity.There are many advantages that come with the use of a planned giving vehicle. Nevertheless, should a client decide to donate tangible objects to an institution, donor-advised fund, or foundation, a tax specialist should be consulted to determine the best option.In conclusion, the field of strategic philanthropy is more sophisticated and complex than ever. More individuals are implementing a philanthropic strategy using collections of wine, art, jewelry and other tangible assets to help make a greater impact in the lives of others. Anyone that regularly writes checks to their favorite organizations and causes can develop a more strategic approach to giving by considering using tangible assets. Nonetheless, the philanthropic process involving these objects begins with understanding what your client owns and understanding the value.

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

[1] 1.14.4.1.5 (04-30-2018) Personal Property Management-Internal Revenue Service Terms/Definitions/Acronyms

[2] IRS Publication 526 (Cat. No. 15050A) Charitable Contributions

[3] IRS Publication 506 Charitable Contributions

[4] Sotheby’s Sale, The Philanthropist’s Cellar: An Extraordinary Collection sold to Benefit Charitable Causes, March 31, 2018.